GE Aerospace Part I: Powering the Future of Commercial Aviation

A Comprehensive Analysis of GE’s Engine Portfolio, Market Leadership, and Long-Term Service Strategy

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available.

Index:

Introduction

The Aviation Market and Engine Suppliers

The Lifecycle of an Engine

Commercial Engines & Services

Competitive Advantages and SWOT

Management: Larry Culp’s Outsider Performance

I. Introduction

Dear Investors,

Today I am pleased to present one of my latest investments: GE Aerospace.

GE Aerospace emerged from multiple spin-offs at GE. It is the company that retained the ticker symbol GE and has quickly become one of the leading companies in the aviation sector.

The stock was trading at $50 per share in 2021 and climbed significantly to reach $200 per share in January 2025. Following volatility triggered by the trade war, the stock experienced a decline to $160 but swiftly recovered to approximately $200 per share.

GE Aerospace holds substantial competitive advantages along with a robust business model, ensuring stable cash flows over the coming decades. The company is uniquely positioned as the primary supplier for the world's best-selling airplanes.

While GE Aerospace designs and manufactures engines for commercial aviation and select military aircraft, it primarily operates as a services company.

In this first segment, we will concentrate exclusively on commercial aviation, which represents 70% of the company's total revenue.

Initial acquisition date: April 2024 Average acquisition price: $184.6

Ticker: GE

Market cap: £247 billion (share price of $231.8 as of May, 16)

II. The Aviation Market and Engine Suppliers

GE primarily focuses on commercial aviation, alongside some military aviation activities. Their core business is commercial aviation, where they supply engines for the majority of Airbus and Boeing aircraft.

Similar to aircraft manufacturing, the engine industry is an oligopoly dominated by three main companies.

Commercial Aviation: Facts and Trends

Introduction

The commercial aviation sector is dominated by Airbus and Boeing, which account for the vast majority of commercial aircraft production. Other manufacturers compete primarily within regional markets.

Aircraft manufacturers do not produce aircraft engines; instead, specialized companies invest billions into research and development to create them. Currently, three companies dominate globally:

GE Aerospace: Leads the narrowbody segment through its joint venture with Safran, CFM International.

Rolls-Royce: Major competitor in the widebody segment.

Pratt & Whitney: Significant player in the narrowbody segment.

Next Generation Engines

The current trend is toward manufacturing narrowbody and widebody twin-engine aircraft, marking the end of the ultra-large aircraft era. New aircraft require larger, more efficient engines.

The latest generation of aircraft engines significantly improves fuel efficiency but may result in slower production rates. These modern engines often encounter initial service-entry difficulties, creating additional pressures on overhaul facilities and parts suppliers.

Hundreds of aircraft are projected to be grounded due to issues with Pratt & Whitney’s PW1000G engines following the discovery of quality defects in powder-metal components, prompting mandatory inspections.

Meanwhile, CFM International’s LEAP engines require modifications to enhance performance under hot and dusty conditions. Rolls-Royce’s Trent XWB-97 has faced criticism due to its frequent inspection intervals, potentially affecting Airbus A350 operations, as it is the aircraft's sole engine option.

Despite these challenges, the long-term outlook remains positive.

Commercial Fleet Forecast

GE generates most of its profits through engine maintenance rather than sales, making fleet size a critical factor. A larger fleet translates to increased profits.

The aviation industry suffered significantly from the pandemic, impacting airlines and manufacturers financially. While trends have shifted, recovery is expected over the coming years.

Key factors for GE’s profits include:

Fleet Growth: A larger fleet implies a higher installed base of GE engines, determined by new deliveries and retirements.

New Deliveries: Newer engines, being larger, generally require more maintenance.

Available reports:

McKinsey & Co - Why aftermarket and service are vital to OEMs—and how to excel

McKinsey & Co - What does the future hold for commercial-aviation maintenance?

Oliver Wyman - Global Fleet And MRO Market Forecast 2025-2035

Boeing - Commercial Market Outlook 2024–2043

Airbus - 2024 Global Market Forecast

Projected Fleet Growth

Publicly available forecasts:

Oliver Wyman: +2.5%

Fleet MRO: +3.1%

McKinsey: +3.4%

Annual fleet growth is anticipated at approximately 3-4% over the next decade.

Deliveries and Retirements

Annual aircraft production and deliveries exceed 2,000, representing about 6-7% annual growth, primarily narrowbody aircraft.

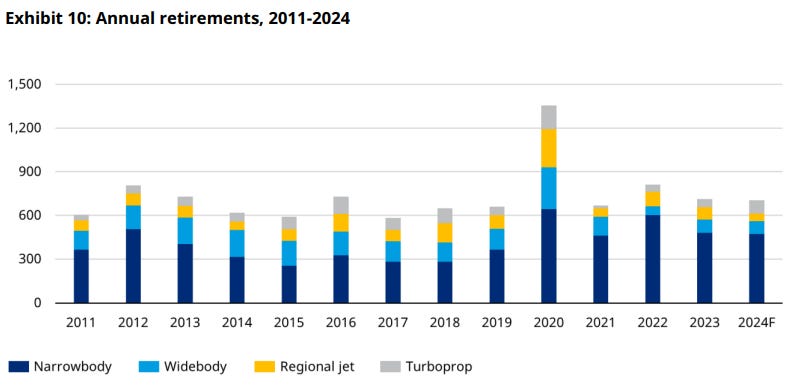

Annually, around 700 aircraft retire (approximately 2% of the fleet), mostly narrowbody. This results in about 1,300 net new aircraft annually, or approximately 2,600 engines, indicating 3-4% fleet growth each year.

Given its dominance in narrowbody aircraft, GE is expected to capture at least half of this market.

GE might capture at least half of the market, with its dominant position in the narrowbody.

The MRO market

Engine maintenance constitutes half of maintenance, repair, and overhaul (MRO) expenditures. McKinsey forecasts a 0.6% annual growth rate, excluding inflation, over the next decade.

However, actual long-term growth may exceed this due to:

Fleet expansion at 3-4% annually, increasing the installed engine base.

Higher maintenance costs of next-generation, larger engines.

Inflation rates around 2-3%.

GE participates in four of the top five platforms projected for highest MRO spending, including the A320neo and B737 MAX.

Keep reading with a 7-day free trial

Subscribe to Asymmetric Ventures Portfolio to keep reading this post and get 7 days of free access to the full post archives.