Gestamp part II: Financials & Valuation

Deep financial analysis and valuation

Valuation of an asset should account at least 1/3 of the investment thesis. Although the quality of an asset is probably the most important thing, valuation matters a lot.

In this post, we will value the 5th largest position of the portfolio: Gestamp. I will go through its financials and perform a valuation of the company. This is the first post of a series of valuation post of my portfolio

In the investment thesis we explained how Gestamp can benefit from the electric car and competition from Chinese manufacturers such as BYD. This post is about their financials and the valuation.

I will analyze the financial statements of the company and perform a valuation of the company.

The investment thesis is available in the following link:

Introduction

Gestamp published results at the end of February and the company's share price fell 10% after publishing a conservative guidance. Along with this fall, some analysts took the opportunity to adjust the target prices.

In the next post we will analyze Gestamp's accounts, future projections and value the company applying different metrics.

During the financial analysis we have not detected anything strange in the accounts and we can appreciate the good management carried out by the board together with the Riberas family.

In terms of valuation, the current prices offer a high margin of safety. Considering the past, Gestamp is a company that has managed to grow faster than the auto market and maintain its margins in the most complicated macroeconomic environment of the last decades.

Disclaimer. Please read full disclaimer at the end of the page before reading the report.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Index

Financial Analysis

Projections

Valuation

I. Financial analysis

Revenue

Operating expenses

Capital expenditures (capex)

Net profit, working capital and cash flows

Financial leverage

1. Revenue

During the last ten years, Gestamp has more than doubled its revenues: from €5.9bn in 2012 to €12.5bn in 2023.

Excluding year 2020 (the year of the pandemic mobility restrictions), the company has grown revenues in every year. Historically, revenues have grown between +5% and +10% annually. Now, the trend looks like it may slow down due to the situation in the European automotive industry. However, revenue should continue increasing in the coming years mainly due to:

The strong momentum in China and North America, where Gestamp is growing at double digits

The EV opportunity: Gestamp will provide more content per vehicle (e.g., battery boxes, etc.), while the remaining content (chasis, body-in-white…) while remain the same

Revenues by region

Europe has been and is the main region for Gestamp. For this reason, the share price is strongly affected by the performance of the European automotive industry. However, the company is increasingly diversifying its revenues, especially by growing strongly in Asia (mainly China).

If you are interested in understanding the trends of the European Automotive industry, I published this report a month ago:

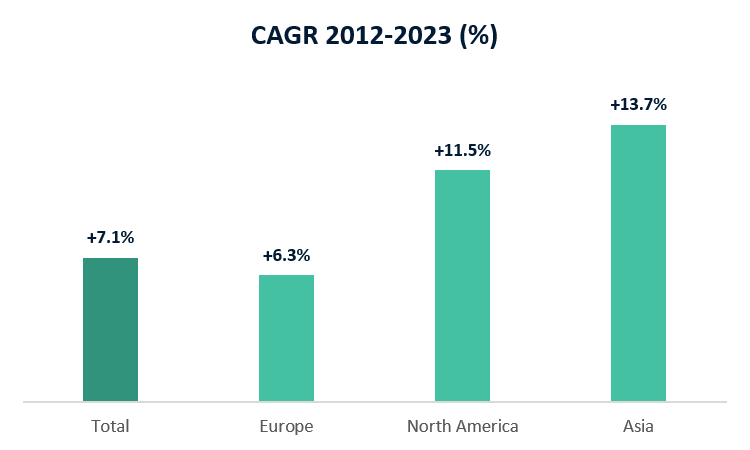

Gestamp's sales have grown at an average of +7.1% since 2012. By region, Europe has grown the least, although at a rate of +6.3%, while North America and Asia have grown at +11.5% and +13.7%, respectively. These are high growth rates for a mature industrial company.

Revenue by product

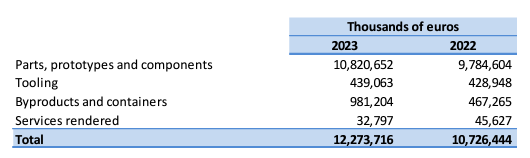

Gestamp mainly sells automotive chassis and steel components. Many of these parts are made specifically for each customer, so Gestamp (like many other automotive companies) has to develop specific tooling, which is charged to each customer (see tooling item in the following table).

Parts and components represent the core of the business, accounting for approximately 90% of total sales

Tooling is the sales related to the tooling required for the manufacture of components

Byproducts and containers are gaining weight with approximately €1.0bn (8% of total sales)

Tooling: high switching costs

The value of tooling is not minor and represents more than €400m each year. This tooling is manufactured before production starts, so once it is manufactured and production starts, it is very unlikely that a customer will cancel the contract and choose another supplier, because it would mean a significant delay in their production.

Therefore, it is a competitive advantage that these companies have. Switching costs are high, so the larger these companies are, the greater the effect of this competitive advantage.

If Gestamp is able to capture the growth in China, it can secure sales for many years. Currently, it has a backlog that covers 92% of projected revenues for 2024-2028.

Revenue recognition: Stage-of-completion method

As the parts are made, goods are created that have no alternative use and the related orders generate rights and obligations wherein control of the parts is transferred to the customer. Since the control of tools and parts is transferred over time, progress is measured using the stage-of-completion method. The method that best represents the progress of the Group’s activities is costs incurred as a percentage of total estimated costs. If the results of a contract cannot be reliably estimated, revenue is recognized only to the extent that the expenses recognized are recoverable.

Source: Annual Report 2023

This method implies that the more a company spends, the more sales it can recognize. In the case of Gestamp, this is mass production where the company receives an order for a number of units, manufactures it and delivers it to the customer. It is reasonable to estimate that if you have manufactured 50% of the order, you recognize 50% of its value as revenue.

This accounting criterion was applied from the introduction of IFRS 15 in 2018:

The impact of this accounting change has the following impact on the accounts:

At the revenue level, the difference is very small. In 2018, the difference was €21m on €8,821m (+0.2%), the impact on net income being €14m). This implies that revenues are not aggressively accounted on P&L.

On the balance sheet:

Inventories of work-in-progress or finished goods are eliminated, due to the fact that they are now classified under assets from contracts with customers as they have already been considered as sales (in the case of finished goods, it is a simple reclassification)

Assets of contracts with customers shows finished or WIP products that are considered as revenue (as there is no substitute use) but the company has not transferred to the client

Net on balance sheet: +€38m receivables

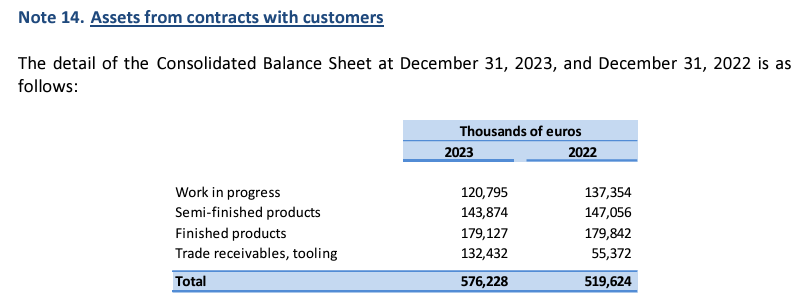

Gestamp recognized €12.3bn in sales during 2023. On the balance sheet, there are €750m in customer contract assets, implying 4-5% of 2023 sales ("Tooling customers correspond to the revenue recognized pending invoicing). Out of the total €576m of assets from contracts with customers, nearly half of them are not finished products:

Representing 4% of the total, this implies that the company does not collect these sales but will collect them later (during the year it collects those of the previous year).

It is not necessary to make adjustments, as this will be reflected in the cash flow (negative working capital adjustment, provided that they record more than they collect from the previous year, which we will see later. It was -€57m in 2023).

Company backlog

Gestamp currently has a backlog of €56.6bn, which implies that the company would have 92% of the sales forecast for 2024-2028 covered.

Customer concentration

Customer concentration is very high, which implies that the bulk of sales depend on a small number of customers. This is a fact inherent to the sector and it is very normal to see a high concentration of customers in each company in the sector.

While the concentration is not disclosed by the company, their clients are the top car manufacturers with global presence. In addition, the company is expanding its client base by penetrating the Chinesse market. Lastly, geographical exposure is also diversified, which mitigates the concentration risk.

Other income

In addition, the P&L includes €100-300m every year of other income mainly third-party billings for transactions different from the companies' main activities. There are some proceeds from sale of PPE but very minor. ç

To be conservative, we will not include any other income in the P&L.

2. Operating expenses

The company's expenses are very high, especially the cost of steel and other raw materials. Costs have historically represented 94-95% of sales.

Costs have doubled since 2012, mainly the cost of raw materials (higher sales, higher costs).

What is important is how Gestamp manages its costs. During 2022 and 2023, inflation got out of control in Europe, while Gestamp has been able to maintain its margins. Costs have remained at 95% of sales.

Raw materials represent the highest percentage since 2012, growing from 59% pre-covid to 64% today

Personnel expenses have declined in the last years relative to revenue

Other opex has been around 12-14% revenue

Detailed opex

a) Raw materials

Raw material expenses are mainly raw materials (mainly steel) and other supplies (not broken down):

Spending on raw materials has been affected by high inflation in 2022 and 2023, reaching 65% of sales (the highest level in the historical series).

b) Personnel expenses:

Gestamp is a company in full growth, so the number of employees has also grown in recent years. There are currently more than 44,000 employees, half of whom work in the production of components.

The average expenditure per employee has risen significantly in 2023 and 2023 due to high inflation worldwide.

c) Other operating expenses

Other expenses have decreased in proportion to sales, mainly because operating and maintenance expenses have grown in a lower proportion to sales, which has allowed us to offset the increase in raw materials:

d) D&A & leases

For Gestamp's valuation, we will treat leases as an operating expense, so we will adjust EBITDA and cash flow to reflect this expense and not consider it as debt.

Leases represent a low proportion of revenues and has decreased over the last years:

3. Capex

Investment needs have been between 7% and 10% of group sales. Currently, capex is around €900m, which compares to €300m of PPE amortization. The company is investing in expanding the business, which can provide ver strong results if the auto market recovers in the mid term.

In is important to highlight that the investments are focused to increase EV capacity. In 2022, 70% of the capex was growth capex related to the EV. As you can see in this chart from 2022, during the 2020-2022 period, half of the capex is growth capex (defined as capex for greenfield PPE, major plant expansions and new customer products/technologies).

As stated in our investment thesis, the EV is an opportunity to Gestamp as its products are technology agnostic (i.e., electric cars use the same body-in-white components) plus it adds new elements such as battery boxes where Gestamp is strongly positioning.

4. Net profit, working capital and cash flows

The company went public in 2017 where net income was €240m. Six years later, net income has modestly increased to €281m, mainly affected by the current macro environment and the weak European auto market.

In terms of FCF, the company generated around €200m of FCF depending on the working capital management:

Working capital

The company does an impressive job in managing working capital with positive WC generated every year.

In terms of operating working capital, the company does a great job and all metrics continue to improve over time. Four out of the last five years had positive working capital (i.e.m the company collected more cash than accrued by the P&L):

Minorities adjustment

Gestamp has minorities in all regions where they operate:

Mexico: Minorities own a 30% stake (should decrease

Brazil: Minorities own 30% stake

Eastern Europe: minorities own 30% of Rusia and 50% of JV in Turkey (fully consolidated by Gestamp)

Asia: In India, minorities hold 49% and in a Chinese company 50% (fully consolidated by Gestamp as the have majority in the Board of Directors)

This implies that there are adjustments to be made:

Net income: on average €40m every year

FCF: dividends vary and FCF from these subsidiaries is volatile. On average, FCF to minorities could stand around €15-20m every year

Balance sheet: There is no breakdown of debt and cash by region. However, around 95% of long-term debt is in Europe, so almost all of the debt is attributable to the shareholders of the Parent company (i.e., Gestamp)

5. Financial leverage

During the pandemic, leverage nearly reached 4.0x (Affected by EBITDA due to lockdowns) and since them, the management has done a great job reducing net debt and leverage.

Gestamp currently has a leverage ratio of 1.5x EBITDA (1.2x excluding leases), which implies a moderate leverage ratio. The management has set a target leverage ratio (including leases) of 1.0-1.5x EBITDA for the next few years. This implies that management is reserving part of the resources for further growth as the ratio is already at the high end and is expected to continue to decline as EBITDA and cash generation increase.

Cash and financial investments

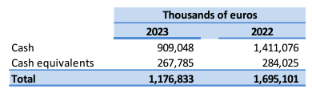

Gestamp reports €1,177 and €150m of current financial assets:

Cash of €909m plus other liquid assets of €268m (total €1,177m)

Financial investments of €150m

Cash equivalents correspond to investments in deposits with maturities of less than 3 months.

The breakdown of financial investments is as follows:

The securities portfolio and other financial investments are mainly short-term deposits, with a significant portion in Brazil (€81m), India (€33m) and South Korea (€19m).

Long term debt: maturities and interest expense

Most of the maturities will occur in the 2026-2028 period, which puts Gestamp in a good short-term liquidity position and allows it not to refinance at current rates.

The current liquidity allows to cover maturities until 2026, so there is no liquidity risk in the short/medium term. Part of this is due to the fact that during 2023 maturities were extended from 2025 to 2027-2028.

The cost of financing is relatively high and is increasing every year due to central bank rate hikes:

Borrowings in Euros: 4.9%-5.9% (vs. 3.0% - 4.3% en 2022)

Borrowings in Brazilian Reals: 2.6%-6.9%

Borrowings in USD: 4.6%

Long term debt instruments:

Syndicated Loan 2023: €1,700m:

Maturity of €850m in May 2027 and €850m in May 2028

April 2018 bond: €400m

Maturity in April 2026

Coupon of 3.25%

Bond Schuldschein October 2019:

Maturity: April 2026

Part has been repaid and €83m of the initial €186m remains (high cost of Euribor 6m + 240 bps).

Guarantees for financial operations:

European Investment Bank (€360m), ICO (€100m) and others (€150m)

Covenants:

Net Debt / EBITDA below 3.5 - 3.75x (only in 2020 has it been this high and that was due to covid. Currently ratio is at 1.5x)

EBITDA / Financial Expenses higher than 3.0 - 4.0x (currently at 7x - 10.x EBITDA depending on the instrument)

Failure to comply with these ratios would be cause for early maturity of the financing at the request of the syndicate of banks

Other limitations: no dividend distribution of more than 50% of net profit (target payout is around 30%)

Rating

Currently, Gestamp is a high yield company according to the rating agencies:

We could raise our rating if Gestamp's steady earnings growth and balanced financial policy translated in adjusted FFO to debt and FOCF to debt sustainably above 45% and 10%, respectively. Although less likely in the near term, we could also raise our rating if the company's cash conversion improves meaningfully, such that its FOCF to debt approaches 15%. S&P, 2023

The rating seems excessive for a company with 1.5x EBITDA ratio. This implies that financing is more expensive for Gestamp. In their last capital markets day, the company stated it was focused on rating improvement. It is important as every notch implies lower financing cost.

According to my projections, it will be complicated to reach a higher rating, but it should comfortably remain stable.

Gestamp's FX risk and debt distribution by currency

Most of the debt is in euros, which implies some exchange rate risk, being a company with global operations. However, as of today, Europe represents ~56% of sales and ~60% of 2023 EBITDA, so the contribution to cash flow from Europe is very significant. North America represents 16% of EBITDA, so ~70% of EBITDA comes from stable currencies, decreasing foreign exchange risk

Leases

Gestamp has €447m in debt from leases, half of which correspond to production plants:

In the valuation we treat leases as an expense and not as a debt item to reflect that expense in perpetuity.

II. Projections

Gestamp’s strategic plan

Main assumptions

Projections

1. Gestamp’s strategic plan

El plan estratégico de Gestamp contempla los siguientes objetivos financieros:

These are ambitious targets, which, if achieved, would imply very high growth. Our projections call for moderate growth and limited improvement in EBITDA margin.

Sales growth is in line with the past.

EBITDA margin improvement would imply reaching a record margin for Gestamp. If there is an improvement in Europe and the management is able to restructure the North American operations, it is possible to increase the margin by 100-150 bps.

The deleveraging can be done without major difficulties, allowing Gestamp to undertake inorganic operations to increase growth if necessary.

2. Assumptions

To value Gestamp I’m using conservative assumptions:

Revenue: CAGR 23-28E +2.8% (vs. 6.9% CAGR 17-23):

Western Europe: +2.4% (vs. 2.6% % CAGR 17-23)

Eastern Europe: +2.8% (vs. 8.6% CAGR 17-23)

North America: +2.6% (vs. +8.9% CAGR 17-23)

Asia:+3.8% (vs. +9.4% CAGR 17-23)

Opex (flat EBITDA margin):

Raw materials to represent 63.0% of revenue by 2026 (currently at 63.9%)

Personnel expenses to represent 14.2% by 2028 (implied CAGR 23-28 of +2.0%)

Other opex to represent 11.5% of revenue (vs. 11.7% in 2023)

Lease expense to increase from €64.5m in 2023 to €102m in 2028

Capex of 7.7% of revenue during the period (2.5% recurrent, 4.0% growth and 1.2% intangibles)

WC to be reduced from 1.3% revenue in 2023 (avg. last 5YR of 1.7%) to 0.0-0.1% during the forecast period

Tax rate of 24% (L3Y average of 22.7%)

3. Projections

This are the base case projections of our valuation:

III. Valuation

Current valuation

DCF valuation

Issues with current valuation

Conclusions and expected returns

🚫NOT INVESTMENT RECOMENDATION🚫

1. Actual valuation

The actual valuation implies a historical low EV/EBITDA multiple of ~3.3x:

Current valuation implies very low multiples, which provide us with a strong margin of safety, with single digit multiples in almost all metrics:

EV/EBITDA at around 3x, down from 4-5x levels in 2021-2022 when the situation was worst than today

EV/FCF however is around 15x, which implies a fair valuation under my 2024 forecast. There is room for improvement if the company increases cash generation to ~€400m (pre interest payments) which is achievable if market recovers. Also note that FCF estimates are conservative and do not include significant WC (although Gestamp has delivered strong WC in the last years)

P/E close to 6x: Do not value Gestamp using a P/E multiple given that FCF is significantly lower than net income given the high investments the company is doing in expanding its production capabilities

Gestamp vs. competitors:

Gestamp is trading below peers, especially in EV/EBITDA multiple and FCF yield. Its group, trades also at lower multiple than other automotive players such as Dana, Brembo, Denso, etc.

2. DCF

🚫NOT INVESTMENT RECOMENDATION🚫

Before continuing, this valuation is my own vision. The sole purpose is for informational purposes only and should not be considered as financial, investment, or professional advice

Under the assumptions made and using the following cost of capital, the implied share price could be close to €5.8 per share, which implies a potential upside of +98%:

WACC of 7.9%: 12.0% Ke (32% weight) + 6.8% after-tax kd (8.0% pre-tax) (68% weight)

g=1.25%

3. Issues with current valuation

There are reasons to believe that the current valuation will persist over time:

The automotive is in a deep recession as the number of manufactured cars still behind 2017-2018 levels

The company didn’t present strong results in the first three months of the year

Unless there is a strong recovery in Europe, the valuation might remain low in the coming years.

A potential solution could be a share buyback, but the company might prefer to maintain current dividend policy of 30% payout

On the positive side:

Current market cap stands at ~1.6bn and the company can generate around €100-200m cash in the next five years (30%-60% of current market cap)

Even if there is not a re-rating, the current valuation offers a high margin of safety and a 5-7% dividend yield for the next years

"Buying something on sale is a good idea, especially if the stock pays a dividend and you can afford to wait."Seth Klarman

If there is a recovery in Europe, the positive impact on the cash generation will be high given the high operating leverage of the company

EV is a strong opportunity for the company as the content per car will continue to increase

Inflationary pressures are beginning to ease; however, this trend needs to be confirmed during the next quarters (see image below)

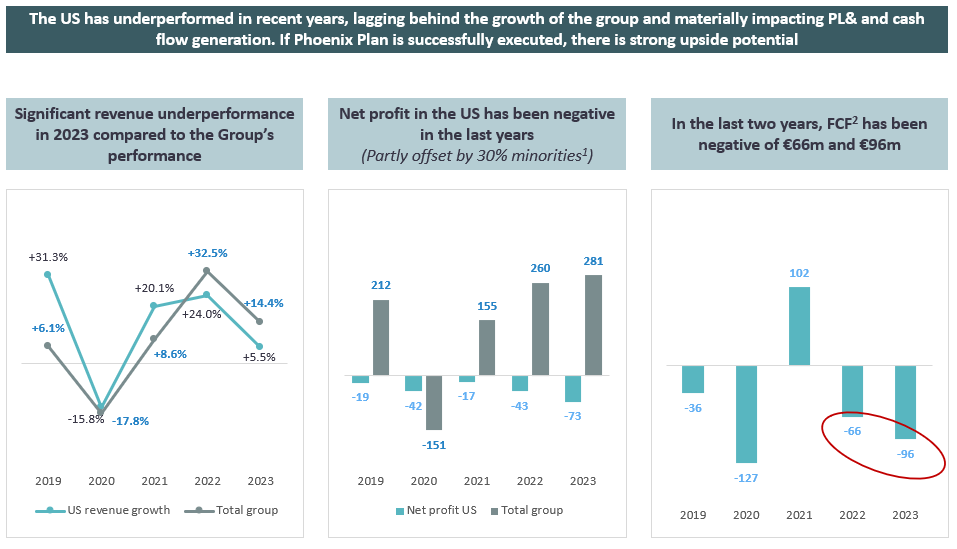

A positive outcome of Phoenix Plan (US restructuring) will imply a strong positive impact on FCF (see image below)

4. Conclusions and expected returns

🚫NOT INVESTMENT RECOMENDATION🚫

The potential returns could stand at 7.5-24.0%, depending on the financials in the year 5 and the applied multiples. Under a conservative approach, IRR will stand at 7.5%, which is in line to historical market return.

If there is an improvement in the European automotive market and company is able to address the issues in their American operations, IRR should reach double digits.

However, share price can still continue to decline if the market situation does not improve. Gestamp can turn to a value trap if Europe continues to decline. While they are expanding in China, there is a strong operating leverage in Europe and its critical that the industry improves in the continent.

A lower rate environment should help to provide more clarity to consumers and allowing to finance cars. The automotive industry is critical to Europe and its important that the EU adopts policies that favor the industry.

I’m still positive given the current low valuation multiples and potential rate cuts in the future. This should increase consumption and demand for new cars. Finally, the easing of inflation should contribute to maintain profitability in the short term.

Thank for reading the report,

The European Value Investor

Thank you for reading the report. Please leave a comment or send me a message if you have any questions or comments. I will be happy to discuss it!

Message European Value Investor

You can also contact me through Twitter:

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.