Porsche AG: a Downward Spiral

I'm selling the majority of my stock in the company after several changes in the strategy. The recent guidance is confusing and suggests low cash flow generation in the coming years.

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Porsche AG Update

Summary of the Current Situation

Porsche AG reported results that were in line with my expectations. However, they reported a very poor guidance and a new change in strategy, which is very confusing.

This was not anticipated, and the result is a very weak expected performance for the next years. This led to a significant share price decrease of -18% YTD, accelerated by the impact of potential U.S. tariffs.

Porsche is a great brand, that makes incredible cars, but currently without a clear direction in its strategy.

In July 2022, the company presented its new strategic plan Road to 20. The main goals were to reach an 80% share of BEV deliveries by 2030, and achieve a 20% return on sales (EBIT margin of 20%). However, the results are from that:

Every single metric has been significantly downgraded. Since July 2022, cash flow is gradually declining and for 2025, it can be half the cash flow generated in 2022.

The company’s financial performance has not been in line with expectations and the guidance of the last two years have been downgraded gradually. From a return on sales of ~17-18% to next year guidance of 10-12%.

Analyst revisions are constant, and forecast EPS has significantly declined in the last year.

This is mainly explained by the constant change in strategy during the last two years:

From an 80% BEV target in 2030, including the launch of new models, to a hybrid model where the company plans to continue offering ICE models well into the 20230s.

Launch of new models. The company now needs to readapt its product offering. The so-called “high flexibility” translates in an €800 million investment in 2025, and according to what analysts asked during the ‘24 results call, we might expect high investments again in 2026. All of these, while selling less cars.

No faith in Chinese market. The management clearly stated “we do not expect to recover in China in the foreseeable future”. This questions the branding power in China: Can Porsche compete against new Chinese players? Is Porsche still perceived as a high-status company in the region? Can this happen in other regions? Will the transition to the EV defeat its main models?

This change in strategy implies high investments, shrinking the FCF generation. From a €4 billion FCF company, to a €3 billion company in the next years.

Under the current guidance, FCF can range between ~€2,700 to €3,600 million. I believe the mid-point is more accurate, and I expect FCF generation in the range of €3,000 million.

Valuation implications

The stock has fell by 60% since the company reached a valuation of €120 per share in summer of 2023, and by c.50% since IPO.

This decline goes in line with fundamentals, which are deteriorating every year.

The impact on valuation of the recent guidance is a potential share price of €50 to €60 per share. I acquired more shares this year, and my average cost is around ~€60 per share. It was a mistake.

Potential impact on share price could be as follows (highly preliminary and ilustrative):

At current prices, the stock could be slightly undervalued, depending on the multiple applied, but overall it looks fairly priced between €50 and €60 per share.

If we exclude the potential tariffs, the current share price of €48 per share is discounting the worst outcome of the guidance provided. This makes sense given the recent history of multiple outlook revisions.

The current average target price of the analyst stands at c.€65 per share, which is c.40% less than in January 2024 and in line with my average cost.

The impact of tariffs

All the above is excluding any potential impact from current U.S. administration proposed 25% tariffs.

I believe it’s too early to discount a 25% tariff scenario. The current proposed tariffs will impact all brands, including Ford and General Motors. Plus, add to this impact the inflation cost of purchasing materials directly in the U.S.

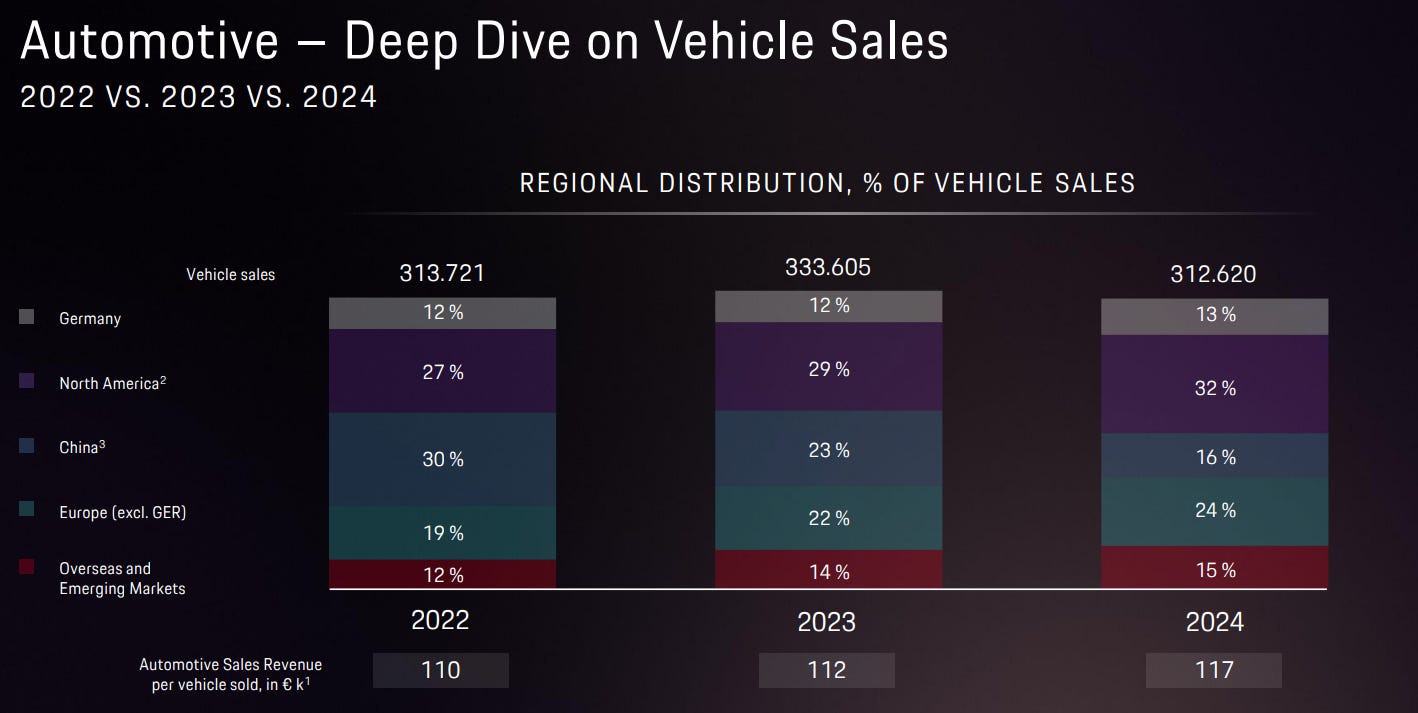

For Porsche AG, the impact is huge. North America represented 32% of 2024 deliveries. The management stated that the intention will be to pass through the impact on prices directly to the consumer (i.e., Americans will buy significantly more expensive Porsches due to tariffs).

A solution could be to start producing in the U.S., but Porsche is a German brand. Doing that will harm the brand positioning.

Porsche vehicles are already at a high cost. Imposing a 25% tariff will have very negative impacts on the company:

Sales will inevitably go down: Probably the 911 will remain resilient. However, the key SUVs (Macan and Cayenne) will be too overpriced to compete in the market.

The impact on consolidated results can be very significant, depending on the outcome. A -10% sales decrease will imply ~€300 million loss for the company, or nearly 10% of the FCF.

Porsche AG will not benefit at all: Cars will cost 25% more, while Porsche will not participate in that price increase. Additionally, every potential future price increase will be done on a 25% higher cost basis, which has meaningful impacts.

In any case, the outcome of tariffs is unknown, and might never happen.

Corporate Governance

Last, I was disappointed with the messages from the management. I saw little self-criticism and the situation of Porsche was only attributed to external factors:

Structural market change in China: They don’t expect demand to recover

Slower ramp-up of EV mobility: Now they are changing the whole plan

Tense situation in the supply chain: Last year, a company like Porsche was disrupted by its suppliers.

The dual CEO structure (Mr. Bloom is CEO of both Porsche AG and Volkswagen) is rising concerns on corporate governance.

Should Porsche be managed independently given the amount of open fronts at Volkswagen?

It was a risk identified in the investment thesis that has materialized in latest change of strategy.

There is an opposite direction between shareholder’s profits, and management compensation:

Last year, the CEO fixed compensation increased by 35%

However, the stock has fell by c.50% since IPO

Its not a clear alignment of interests.

Conclusion: My First Mistake in the Portfolio

I purchased shares at an average cost of €62 per share. At that time, valuation was fair when the company was generating €4-4.5 billion of FCF. Now, these figures seem far away.

It will take several years to recover, and I don’t expect the company to generate a higher FCF than when I acquired. This means that I’m considering a permanent loss of capital.

The daily volatility of a stock is not the risk we face as investors. The real risk is a permanent loss of capital, which is due to a change in fundamentals.

If I acquired Porsche shares at fair valuation when the company generated €4-4.5bn of FCF, now that I don’t expect the FCF generation close to that in the next two years, the result is a permanent loss of capital.

Can the valuation recover? Yes, but it will require several years.

I will be selling the stock once I find my next idea.

Going Forward: A Strong Product Offering

The comprehensive product offering in 5 years from now should contribute to a strong sales performance, but will also increase the complexity of the company.

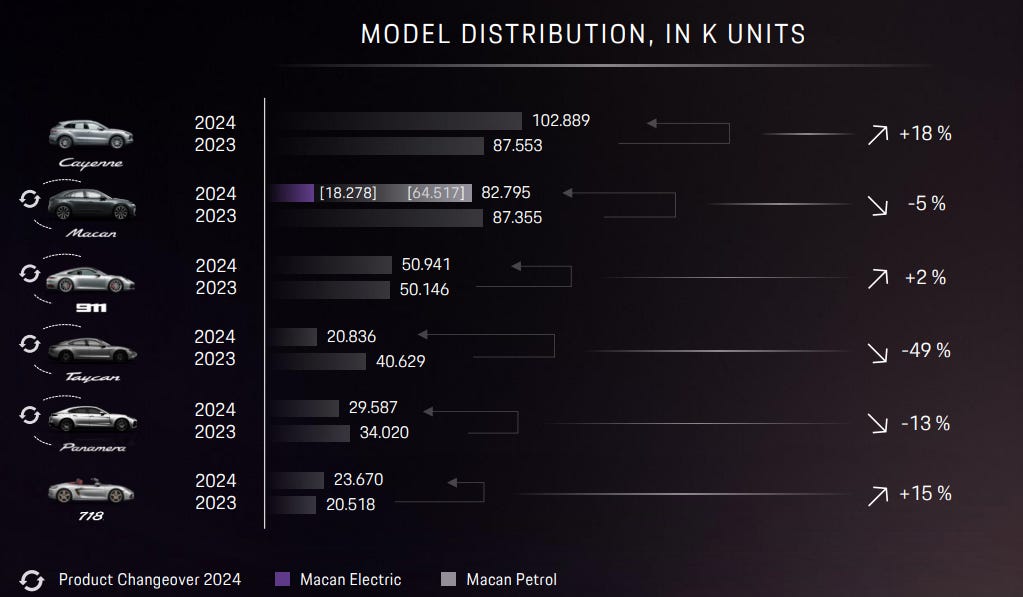

Iconic 911: The company will launch some additional versions this year. However, the impact on sales is limited, as the company delivers 50,000 units and we can’t expect this to increase significantly (and it shouldn’t).

The 718 series, including the Boxter, will soon turn to electric. The outcome is unclear, but it will be one of the only two-door EV cars in the market.

SUVs: This is the leading category in the market right now. The company will launch a new SUV in the Macan segment. These are positive news. Additionally, they announced a large 7-seat SUV.

Cayenne remains the most important car for Porsche, representing 1/3 of total deliveries (above 100,000 in 2024). This model remains as ICE/Hybrid, and a new electric version will be introduced soon. The reliance on this model seems excessive.

Macan: It’s currently a mess. There is a new EV version in Europe, and in areas like North America, the company sells both the old ICE and the new electric.

Company announced a new EV that will compete close to the Macan.

There are little updates on the 7-seat SUV (Porsche K1 project)

Sedans: It is unclear how the sedan models Panamera and Taycan will evolve in the future;

Taycan: Although it’s a great car, the demand is very low: From a peak of 40,629 units in 2023 to 20,836 units delivered in 2024.

Panamera: The fall in China creates a strong challenge for this car, that is 16 years old. We are in the second generation, but it’s an old category which sales are stagnated.

The product offering will be compelling. But it will also be a mess. The company will be offering too many models with multiple variants and a lot of options to customize vehicles.

In my personal opinion, it seems that there is no clear roadmap. This is impacting the investors’ sentiment, and rising concerns regarding corporate governance.

After several years of outlook downgrades, it seems difficult to believe on future performance. And, according to the investor’s presentation, there is a long way before the company will recover to margins close to 16-18%.

Lessons learned

When I purchased Porsche, the return profile was not very high. Although it has a powerful brand, I believe the company should navigate the current turmoil in automotive markets better than its competitors.

I identified potential risks, but I didn’t expect a shift in the strategy. I believe Porsche brand is still on e of the most powerful brands in the automotive industry. Its cars are among the best in the industry.

The main lesson is very simple: I acquired Porsche at 14-15x FCF. For one of the best German automotive companies, the multiple seemed appropriate. It could be higher due to Porsche’s brand. But it seemed a fair valuation given the current market environment.

Porsche is an extraordinary brand, which incredible cars, but not an extraordinary business. It’s a mistake to acquire a good (but not extraordinary) business at its fair valuation because there is no margin of safety. This stock was clearly out of the portfolio style. It was not an asymmetric bet with high upside potential.

I allocated ~7.5% of the portfolio to this company, and lost nearly 25% in the investment. This means around ~2% of the portfolio value. It’s not a huge loss on aggregate and I expect to recover with the next investment.

I will sell the stock once I found a better opportunity. In the meantime, the stock might recover a little bit, but I don’t expect to earn profits on this investment.

Appendix

PORSCHE AG RESULTS 2024

Financial Performance & Guidance

Porsche AG achieved record sales in 4 out of 5 geographical regions, with Average Selling Price (ASP) rising from €112K to €117K.

However, in terms of profitability, Operating Profit declined by 24%.

Outlook

The company announced a dividend of €2.31 per share and provided guidance for revenue between €39-€40bn, EBIT margin of 10-12%, and net cash flow margin of 7-9%, implying a free cash flow (FCF) between €2.7bn and €3.6bn.

Free Cash Flow (FCF) has declined progressively from €3.866bn in 2022 and €3.973bn in 2023 to €3.735bn in 2024.

Key Challenges

Porsche management identified three major challenges:

Structural market changes in China.

Slower-than-anticipated ramp-up of EV mobility.

Continued supply chain tensions.

Due to these factors, the target of selling 80% EVs by 2030 is no longer realistic, leading Porsche to adjust its product strategy to include combustion, hybrid, and EV powertrains.

The company does not anticipate recovery in China, suggesting reduced participation in future regional growth.

Product Strategy and Upcoming Launches

Porsche currently has the youngest product portfolio in its history (in terms of cars updated, but many models have more than a decade), with several launches planned:

A new variant of the 911.

A new SUV positioned close to the Macan segment, planned within 36 months.

Electric versions of the Cayenne and 718 scheduled for 2026.

The Cayenne and Panamera will maintain all three drivetrain options (ICE, Hybrid, EV), with significant renewals scheduled by the end of the decade, focusing on updates and software improvements in the interim.

BEV share remains stable at approximately 12.7%, with low demand for the Taycan.

Investments and Production Capacity

Porsche plans €800M in investments to expand capabilities:

€300M in products, exclusive manufacturing, and software.

€200M in battery-related initiatives (Cellforce Group and V4Smart).

€300M for organizational changes.

Additionally, the company will increase capacity in exclusive manufacturing and the Sonderwunsch customization program.

It remains unclear how much the company will continue to invest after 2025. According to the following chart from the investor presentation, we can expect capex and R&D to remain very high in the following years.

This comes along a poor guidance in terms of sales, and messages from the CEO saying the company is preparing to remain profitable at 250,000 units sold (although the goal is ~300,000).

Deliveries and Production

Deliveries declined slightly to 310K units in 2024 from 320K in 2023:

911: 50.9K (2024) vs. 50.1K (2023)

718: 23.7K vs. 20.5K

Macan: 82.3K vs. 87.4K

Cayenne: 102.9K vs. 87.6K

Panamera: 29.6K vs. 34.0K

Taycan: 20.8K vs. 40.6K

Production in 2024 stood at 303K units, with Cayenne remaining the company's sales leader despite declines in Taycan and Panamera sales.

By looking at the figures, the Cayenne sales look exceptional compared to previous years. On the other hand, the Taycan sales signals that there is very little demand for high-end electric vehicles.

The Taycan is an incredible car, but it might not be worth for consumers to spend €100,000+ on an EV that might be outdated in a few years. That has been a mistake of my investment thesis.

Other companies like Tesla sell a lot of cars because they are not that expensive and technologically very advanced. The Taycan is really great car, but might be too expensive given the potential residual value decline once EVs start to perform better every year.

Executive Compensation and Governance

Executive compensation increased significantly despite declining performance:

Oliver Blume:

Fixed salary increased from €800,000 in 2023 to €1,085,000 in 2024

Total remuneration rose to €3.32M (2024) from €3.15M (2023).

Lutz Meschke:

Total remuneration: €3,287,041 in 2024 compared to €3,424,787 in 2023.

Concerns were raised regarding governance, as EBIT margin decreased from 18% in 2023 to 14.1% in 2024, yet executive remuneration increased. The company justified this increase by citing market competitiveness.

The Customer Excitement Index decreased from 46.7% (2023) to 45.5% in 2024, reflecting lower overall customer satisfaction.

🚩It’s a red flag to see increasing compensations by 35% despite the bad performance of the business. I don’t think shareholders and management are aligned at this point. The stock is down nearly 50% since IPO , while retribution from the management has increased far more than inflation.

Valuation and Financial Metrics

Current valuation:

Market capitalization: €48.7bn

Automotive net liquidity: €8.56bn

Pension provisions: €4.07bn

Enterprise Value (EV): €44.25bn

FCF 2024: €3.735bn EV/FCF (2024): 11.8x

Projected FCF 2025: ~€2.7bn, resulting in an EV/FCF multiple of ~16x.

Outlook, Risks, and Concerns

The previous target to reach 80% EV sales by 2030 is now considered unrealistic, requiring continued significant investments. Analysts remain skeptical about margin improvements by 2026, given unclear strategies and ongoing structural challenges, particularly in China.

Additionally, Porsche announced job cuts in the China region, highlighting shifting consumer preferences towards local brands.

Oliver Blume will continue as dual CEO for the foreseeable future.

Capital Allocation

Porsche plans to distribute dividends totaling €2.1bn (€2.31 per share) despite declining margins and profitability.

Market and Customer Trends

Revenue remains stable, with consistent sales above 300K units annually since the 2022 IPO. However, customer satisfaction slightly declined, with the Customer Excitement Index dropping from 46.7% in 2023 to 45.5% in 2024, suggesting mixed customer feedback regarding product quality, experience, service, and digital connectivity.

This is not investment recommendation. It’s just my humble opinion.

We were unable to load this poll. Please refresh the page.

Thank you for reading the report. I really appreciate your support. If you enjoyed it, please hit the like bottom, subscribe and leave a comment to stay in touch!

Thanks for this. Sorry it didn't work out as planned. But I really appreciate your honest and transparent thoughts on what you were seeing at the time you bought and how it turned out. Sharing your struggles and thought process helps us all.

Porsche is a sharp contrast to Ferrari today unfortunately. A CEO at two companies while not being held accountable just doesn't make sense