Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Dear readers,

Today I bring you my latest investment: Sky Harbour Group Corporation (SKYH).

Sky Harbour Corporation has become one of the top positions in the portfolio. After conducting a deep analysis, I believe this company remains under-analyzed by the broader market despite strong growth prospects. Over the past year, the share price has remained largely unchanged, creating a compelling opportunity to acquire shares at an attractive valuation.

It has an excellent management team behind, and is in the early stages of its expansion strategy, having secured 16 ground leases compared to a medium-term goal of 50.

At the current valuation, investors gain exposure to these 16 campuses—five of which are already operational—at an attractive valuation, while also receiving potential upside from any future growth for free.

Management is confident that they will reach their medium-term goal of 50 airports.

This investment opportunity originated from an in-depth analysis of Boston Omaha Corporation (BOC), which is also part of our portfolio but with lower exposure.

I. Sky Harbour Group Corporation in a Nutshell

Sky Harbour Group Corporation

Ticker: SKYH

Currency: US$

Market cap: ~$820 million (February 14th, 2025)

Acquisition price: $11.11 per share

Introduction

Sky Harbour is a real estate and infrastructure company specializing in private aviation hangar facilities.

The company was founded by Tal Keinan (56), who identified a substantial supply-demand imbalance in the industry while seeking storage for his private aircraft in the New York metropolitan area. Recognizing the inefficiencies in existing services, Sky Harbour was established to provide a superior alternative.

Value Proposition

Sky Harbour aims to redefine the private aviation hangar industry by:

Providing premium private hangar space for business aviation aircraft through long-term lease agreements.

Enhancing service quality by delivering a superior alternative to existing fixed-base operators (FBOs), which primarily rely on fuel sales and transient traffic.

The U.S. has the largest private aircraft fleet in the world of around 22,000 aircraft1. However, the hangar supply has not kept pace with the industry's growth.

Industry Landscape

The private aviation infrastructure industry is dominated by a few major players that generate revenue primarily from traffic-based sources (e.g., margin on fuel sales). However, no company currently offers a nationwide service for private and hangar space.

Sky Harbour is uniquely positioned to fill this gap by developing a network of private aviation campuses across the United States.

Market Opportunity and Expansion Strategy

Sky Harbour aims to establish a presence in 50 airports by the end of the decade.

Currently, the company is developing campuses at 16 airports, some of which are already operational, with plans for continuous annual expansion. However, the development process is inherently slow due to the complexities involved in completing new projects.

Competitive Landscape and Barriers to Entry

Sky Harbour is the only company offering private hangars on a national scale in the U.S. While some local providers exist, none operate at a nationwide level.

Over the next decade, competition is likely to emerge. However, by that time, Sky Harbour will have already established a strong presence in numerous key airports. Several factors create significant barriers to entry for new players:

Land Scarcity: Many airports face constraints on available land, and the development of additional hangars must compete with other airport uses such as logistics, commercial aviation, and maintenance operations.

Long Development Timelines: Establishing a campus is a lengthy process, often taking several years from site sourcing to construction.

Capital Intensity: Developing these facilities requires substantial investment. Sky Harbour is set to deploy hundreds of millions of dollars, with a typical campus requiring an investment of $50 million, and some locations necessitating up to $70 million.

📌Even if new competitors emerge, the substantial gap between supply and demand, particularly in major metropolitan areas, ensures that there is ample room for multiple operators in the market.

Valuation and Growth Potential

At the current share price, the market does not account for any value creation beyond the 16 ground leases already signed with airports. Based on my estimates, this effectively means that all future growth is being overlooked, creating an attractive investment opportunity.

Furthermore, the company’s financial statements do not yet reflect its true future earnings potential, as these will only materialize once all the campuses are fully operational.

Investment Thesis

At the current share price, I am effectively purchasing shares in Sky Harbour at a valuation that assumes no expansion beyond the 16 airports currently under development.

Any future growth beyond these locations, as well as any upside in the existing business, is essentially “free” from an investment standpoint.

II. The Private Jet Industry: What Do We Need to Understand?

General Aviation

General Aviation (GA) encompasses all civil aviation activities outside of scheduled commercial airline operations and military aviation. This includes:

Private flying – Personal and recreational flights.

Business aviation – Corporate jets and executive flights.

Flight training – Pilot training schools.

Aerial work – Agriculture, firefighting, surveying, and photography.

Charter flights – On-demand air taxi services.

Medical flights – Air ambulance and emergency medical services.

GA aircraft range from small single-engine planes to large corporate jets and helicopters, playing a vital role in transportation, industry, and emergency services.

The Scale of General Aviation in the U.S.

As of 2018, the U.S. GA fleet exceeded 200,000 aircraft, illustrating the significant space required to store and maintain them. This number includes both private and commercial aircraft, which collectively demand millions of square feet of storage space.

Every aircraft requires dedicated land to be parked. With over 200,000 GA aircraft, plus commercial and military planes, the total storage demand reaches millions of SF of space

The Growing Challenge of Aircraft Storage

With the increasing number of private jets, securing adequate storage space has become a pressing issue. Several factors contribute to this challenge:

Limited Airport Space — Airports have fixed boundaries and cannot expand indefinitely.

Larger Jet Sizes — Newer private jets require more space due to increasing dimensions.

Competing Land Uses — E-commerce and logistics demand valuable airport real estate.

Additionally, the Federal Aviation Administration (FAA) regulates where aircraft can land and park, further restricting available storage options.

Business Jet Storage Requirements

There are Light, Medium, and Large Jets – These are the most common choices for business aviation due to their speed, range, and comfort.

Midsize jets require approximately 5,000 SF of hangar space, while large jets may need up to 10,000 SF.

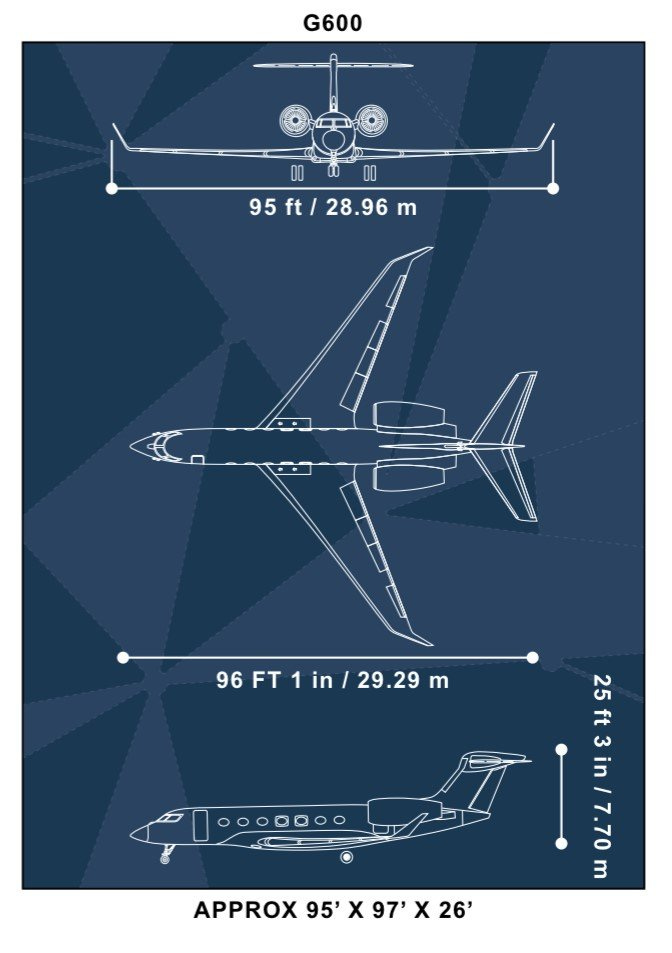

Sky Harbour is designed for medium and large jets. The difference in size is important, as larger jets require significantly more space:

A key issue in business aviation is that planes spend more time on the ground than in flight, necessitating secure storage solutions.

📌 Examples of Space Requirements for Business Jets

Large Jets (e.g., Gulfstream G600)

Requires at least 9,120 SF of space.

Wingspan of 30 meters (100 feet) demands hangars of at least 35-40 meters (100+ feet) in length.

Winglets prevent efficient stacking or overlapping of aircraft.

High tail heights of 25+ feet necessitate hangars of 10-12 meters (3-4 stories high).

Medium Jets (e.g., Bombardier Challenger 650)

Requires around 5,000 SF of space (64 ft wingspan x 68 ft length).

Lower height (20 ft) makes them easier to store than larger aircraft.

Sky Harbour initially targeted the largest jets but has since expanded its offerings to accommodate smaller business jets, given their significant market presence.

🗣 “You’ve got plenty of hangars—especially in the higher-end locations such as the New York area—that have 28-foot-high doors. But most of the installed base in the country is 24 feet and down because when these hangars were built 30 to 40 years ago, that would have accommodated the tallest business jets.”

Tal Keinan, CEO2

The Scale of Hangar Space Demand

According to a report from CBRE (see appendix for further details), the number of business jets in the U.S. exceeds 22,000 aircraft. If all were stored in hangars, the total space requirement would exceed 110 million SF—equivalent to 2,000 football fields.

Storage Options for Private Jets

There are several options to park a private jet:

Apron (Outdoor Parking), or

Community hangar (Shared Storage), or

Private hangar

Before exploring storage alternatives for private aircraft, it’s essential to understand the role of Fixed Base Operators (FBOs).

🛩️ At virtually every airport in the United States, there is an FBO - a facility that functions like a hotel + gas station for planes. These companies not only manage aircraft parking space but also provide essential services such as fueling, de-icing, and maintenance. The two largest FBOs are Signature Aviation and Atlantic Aviation.

The main difference between storing a plane at an FBO vs. Sky Harbour is that at an FBO the plane is typically stored outside on the apron whereas at Sky Harbour the tenants have their own dedicated private hangar.

1. Apron Parking (Outdoor Storage)

The simplest and most cost-effective option is parking the aircraft on the apron at an FBO. However, this approach has several drawbacks:

Exposure to Weather – Aircraft are vulnerable to extreme temperatures, rain, snow, and solar radiation.

Security Risks – Increased risk of vandalism or unauthorized access.

Potential Damage – Ground collisions (e.g., wingtip accidents) can cause costly repairs and flight delays.

🗣 “You would not purchase a Ferrari or Corvette and leave it exposed to the elements or parked in the street overnight,”

Stephen Myers, executive vice president of Elite Jets3

2. Community Hangars (Shared Storage)

“A hangar offers protection from the weather, but most importantly, a sense of security knowing the jet is safe and sound—and securely stored out of sight—while you are away.”4

FBOs often provide shared hangars, offering better protection but presenting their own challenges:

Limited Privacy – Shared hangars lack exclusivity, making them unsuitable for high-profile individuals who prioritize discretion.

Scheduling Inconvenience – Access to the aircraft may be delayed due to other planes blocking exits.

Restricted Storage – Owners cannot store personal belongings, vehicles, or spare parts inside a shared hangar.

Risk of Damage ("Hangar Rash") – Frequent aircraft movement increases the likelihood of accidental scrapes or collisions. Some examples of hangar rash include:

A technician misjudging distance and bumping a wingtip into a hangar door.

A baggage cart scraping the fuselage while maneuvering near an aircraft.

A tow bar failure causing an aircraft to roll into another parked plane.

“The issue with community hangars is that they open and close more regularly, which gives birds a chance to come in. They're a chronic problem. Often hangar doors are left open to make it easier, which means birds can just come and go as they please”.5

Additionally, according to the CEO of Sky Harbour, the contracts signed with FBOs allow them to park the plane outside if needed.6 So, the airplane might be parked outside without the owner knowing it.

Imagine owning a $50–$70 million jet but having no control over where it is parked at the airport.

3. Private Hangars (Sky Harbour’s Model)

Sky Harbour offers a premium alternative by providing dedicated hangars exclusively for business jet owners. Unlike community hangars, where aircraft may be parked outside without the owner’s knowledge, Sky Harbour’s tenants have full control over their storage space.

Sky Harbour is able to charge an 80% to 100% premium compared to FBOs.

The Shortage of Hangar Space

The lack of available hangar space is one of the biggest constraints in the business aviation industry:

Many existing hangars are outdated and unable to accommodate the increased height of modern private jets.

Waiting lists for hangar space are long, making private hangars even more valuable.

Airports like Teterboro (NYC area) are overcrowded, forcing many aircraft to park outside or relocate to other airports (i.e., repositioning).

🗣 “Hangar space is a scarce commodity. This caused some owners to consider either sharing a hangar or parking their aircraft at a less desirable airport,”

David Gitman, president of Monarch Air Group7

The increasing demand for private jet storage, coupled with the shortage of suitable hangar space, positions Sky Harbour as a unique and valuable player in the market. With its premium, dedicated hangar solution, the company provides a superior alternative to traditional FBOs, catering to the most affluent jet owners.

III. Market Opportunity: The Growing Demand for Private Jet Hangar Space

The Increasing Number of Private Jets

Sky Harbour focuses on the top-tier owners of private jets, targeting the most valuable segment of the market. The total fleet of business jets in the U.S. is over 22,000 aircraft, and this number continues to grow.

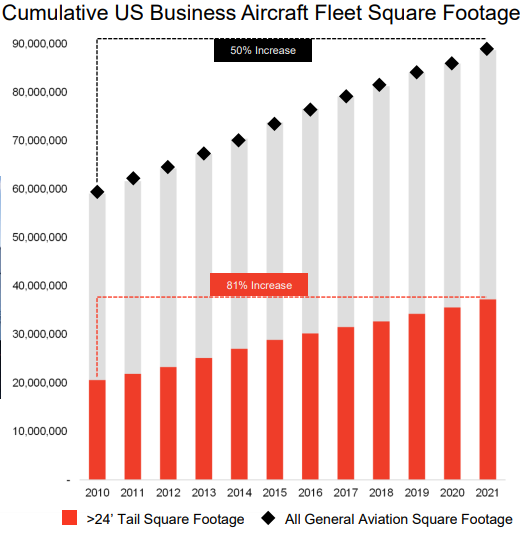

According to Sky Harbour’s management, the total square footage occupied by the U.S. business aircraft fleet has expanded significantly from 2010 to 2021:

In just a decade, there has been an increase of nearly 30 million square feet (~279 hectares, equivalent to 520+ football fields).

📏 For European readers: 1 square foot (SF) = 10.764 square meters (sqm), so you can approximate figures by dividing SF by 10 or 11.

This trend is expected to continue, driven by leading manufacturers like Bombardier, Gulfstream, and Dassault, which are producing larger private jets than ever before.

And this trend is projected to continue through 2030:

Scarcity and Rising Demand

The more aircraft produced, the more hangar space required, intensifying the supply-demand imbalance.

✅This trend strengthens the pricing power for both Sky Harbour and FBOs.

While there was a pandemic-driven surge in private jet demand, even if future production slows, the existing fleet will remain operational for decades, reinforcing the long-term scarcity of hangar space.

The Supply-Demand Imbalance in Airport Infrastructure

Airports Face Severe Land Constraints

Airports are highly regulated infrastructure assets with limited available space, making new developments challenging:

Master plans are designed for long-term periods and do not quickly adapt to rising demand.

Land availability is minimal, particularly in major metropolitan areas.

Regulatory and environmental constraints further limit development opportunities.

📍 Example: San Jose Airport, where Sky Harbour operates, has no available land for further expansion.

Existing Infrastructure is Outdated

Most airport infrastructure was designed decades ago, and many hangars are too short to accommodate modern business jets, which are larger and taller than older models.

✈️ The new norm in private aviation is the acquisition of larger jets for increased speed, range, and luxury. The larger the jet, the taller the hangar must be.

💡 Sky Harbour has designed its hangars specifically to accommodate these aircraft.

A Saturated Airport System

The situation at many airports is one of extreme congestion:

Hangar occupancy rates exceed 100% in major hubs, leading to long waiting lists for space.

Demand for hangar space is growing much faster than supply, with only a handful of new developments each year.

The rise of e-commerce has increased competition for airport space, as logistics operations expand their footprint.

Aircraft maintenance facilities also require additional space, further limiting available land for hangars.

Airport Expansion is Not a Viable Solution

The fundamental issue is that airports cannot expand indefinitely. A review of Sky Harbour’s locations indicates that most airports have very little land available for new developments.

New airports are unlikely to be built—especially in major cities—due to the enormous land requirements and regulatory hurdles.

Even where land exists, it cannot be assumed that it will be allocated for private jet hangars.

Airports must balance multiple priorities, including light aircraft, commercial aviation, cargo logistics, and maintenance facilities.

Regulatory and Community Restrictions

Airports are highly regulated, with multiple stakeholders influencing expansion decisions:

Noise regulations and environmental concerns limit airport growth.

Local governments and communities often resist expansion projects that increase traffic, noise, or emissions.

Airports are beachfront property

Just as oceanfront real estate is limited and valuable, airport land is similarly scarce and highly sought-after.

While new competitors may emerge, Sky Harbour has a decade-long head start, allowing it to secure prime locations before the competition arrives.

Why Speed Matters: Sky Harbour’s Competitive Advantage

Sky Harbour’s accelerated development strategy is critical. In this industry, being the first mover is a massive advantage.

By rapidly securing some of the last available plots of land at key airports, Sky Harbour is positioning itself as the dominant player in premium private jet hangar space.

🏆 First-mover advantage in securing scarce airport land is a key differentiator for Sky Harbour’s long-term success.

IV. The Role of FBOs

Understanding the dynamics of an airport requires analyzing its key stakeholders, infrastructure, and business models. This section outlines the primary types of private jet owners and the role of Fixed Base Operators (FBOs) in airport operations.

Types of Private Jet Owners

Private jet ownership can be categorized into three main groups:

Private and Corporate Owners – Individuals or corporations that own entire aircraft for personal or business use.

Fractional Owners – Multiple individuals share ownership of an aircraft, often through programs offered by companies like NetJets or Flexjet.

Charter Operators – Companies that operate private jets similarly to an airline, offering on-demand flights without requiring ownership.

Each type of owner has different storage and service requirements, influencing the airport ecosystem and the demand for hangar space.

🎯 Sky Harbour targets the top owners of private jets (from ultra wealthy individuals to the top corporations in the country).

Aircraft Storage: The Role of Fixed Base Operators (FBOs)

FBOs manage the essential infrastructure and services for private aviation at airports. These services include:

▪️ Aircraft parking (apron space)

▪️ Hangar operations

▪️ Fuel services (primary revenue source)

▪️ Passenger terminals and lounges (for private aircraft owners, not the general public)

▪️ Aircraft maintenance and de-icing

At every general aviation airport, there is at least one FBO responsible for servicing private aircraft. Like Sky Harbour, these companies operate by signing ground leases with the airport.

Standard FBO Infrastructure

A typical FBO includes:

Hangar space – Indoor aircraft storage.

Terminal facilities – Lounges, offices, and crew amenities.

Parking (Apron space) – Outdoor aircraft parking.

Fuel farms – Onsite fueling infrastructure.

📍 Example: Signature Aviation’s installation at Teterboro (TEB) – An example of a full-service FBO facility.

Major Players in the FBO Industry

The FBO sector has undergone significant consolidation, with private equity firms acquiring the largest players:

Signature Aviation – Acquired by Blackstone in 2021.

Atlantic Aviation – Acquired by KKR in 2021.

Additionally, many regional and independent FBOs operate across various airports, but the industry has seen substantial M&A activity, leading to increased market concentration.

The Business Model of FBOs vs. Sky Harbour

FBOs and Sky Harbour have fundamentally different business models, despite both being involved in private aviation infrastructure.

Unlike the FBOs, the majority of Sky Harbour’s revenue comes from long-term rental leases. Sky Harbour provides fuel, but only to their tenants, not to transient traffic.

Key Differences:

FBOs rely on transient traffic and earn most of their revenue from fuel sales, which are cyclical and affected by economic conditions.

Sky Harbour focuses on long-term, dedicated hangar space, ensuring stable rental income from high-net-worth jet owners and corporations.

🔒 Sky Harbour's business model is more predictable and resilient than that of traditional FBOs, as it does not depend on fluctuating fuel sales or transient traffic.

V. Sky Harbour’s Solution: Redefining Private Jet Hangars

A Unique Value Proposition

Sky Harbour provides private hangars for high-net-worth aircraft owners who prioritize privacy, exclusivity, and control over their space. Unlike traditional community hangars, where aircraft share facilities, Sky Harbour offers a dedicated, luxury environment tailored to the needs of elite private jet owners.

As a result, Sky Harbour has become the home for many private jets, catering to individuals who demand the highest levels of security and discretion.

🏛️Unlike FBOs, which cater to transient aircraft, Sky Harbour is a premium real estate business, offering exclusive, long-term aviation infrastructure.

Sky Harbour vs. Traditional FBOs: A Luxury Offering

Some might argue that Sky Harbour's service is similar to what FBOs like Atlantic Aviation or Signature Aviation offer. Both solutions allow clients to fly safely, park their aircraft at the airport, and travel from point A to point B.

However, luxury is not about utility, it’s about exclusivity. Sky Harbour is a luxury real estate provider with several key differentiators:

Their hangars provide exclusivity and status, as these are unique properties in the most luxurious sector of private aviation.

Scarcity – Sky Harbour offers highly limited airport real estate. It’s almost irreplicable in many locations.

Premium Pricing – The service is leased at a significant premium compared to FBOs.

High-End Clientele – Designed for an ultra-wealthy customer base, large corporations, and charter companies.

🏛️Tenants are renting the equivalent of a beachfront property in Monaco. These pieces of land are incredibly scarce and unique.

The Key Features of Sky Harbour’s Solution

Exceptional service = exceptional brand —> Exceptional brands are more desired than mediocre brands and have stronger pricing power.

🗣 “A lot of that has to do with the fact that when you don't have a transient business, there are all sorts of service attributes that you can create and that we think really add tangible value for our residents.”

Tal Keinan, CEO - 2Q ‘24 results

1. Full-Time, Individual Hangar Storage

Sky Harbour tenants enjoy round-the-clock, exclusive hangar space, offering several advantages over community storage:

▶️ Uninterrupted Aircraft Maintenance – No scheduling conflicts.

▶️ Enhanced Aircraft Longevity – Protection from weather elements reduces wear and tear.

▶️ No Hangar Rash – No accidental damage from other aircraft movements.

▶️ Temperature-Controlled Facilities – Helps prevent corrosion and protects sensitive equipment.

▶️ Lower Insurance Costs – A safer storage environment results in reduced insurance premiums.

▶️ No De-icing Required – Sky Harbour hangars eliminate costly de-icing procedures.

🗣 “They don't need de-icing, right? They only come out when they're ready to fly. They're not like an FBO where the airplanes live on the ramp outdoors. They're getting snowed on, frosted on, you can't take off an aircraft when it's frosted. By the way, that's a many, many thousand-dollar operation to de-ice an airplane and environmentally, it's not a great situation.”

Tal Keinan, CEO (2Q ‘24 results)

2. A Private and Secure Space

Sky Harbour tenants enjoy unparalleled security and privacy, which is essential for high-profile individuals and corporations:

▶️ Restricted Access – Controlled entry points ensure privacy.

▶️ Direct Parking Inside the Hangar – Owners can drive directly to their aircraft.

▶️ Zero External Traffic – No other planes move in and out of the hangar.

▶️ Private Offices & Lounges – Exclusive amenities ensure a seamless experience.

▶️ Always Closed Doors – Maintains security and discretion at all times.

🗣 “If a person can afford to own and operate a private jet, why on earth would that person choose to keep it in a shared space?”

Founder of Cloud Nine, recently acquired by Sky Harbour (Camarillo Airport)

3. A Modern, Flexible Space Designed for Large Aircraft

Unlike older hangars, built decades ago, Sky Harbour’s facilities are designed for modern private jets, providing:

▶️ Customizable Space – Tenants have full control over hangar configurations.

▶️ Dedicated Storage - Tenants can store equipment, vehicles, and other assets in their hangars.

▶️ Private Lounges & Offices – A workspace within the hangar.

▶️ Comprehensive Aircraft Services – Fueling, water, lavatory services, and cleaning.

▶️ Foam-Free Fire Suppression – Unlike traditional hangars, Sky Harbour’s smaller hangars eliminate costly foam suppression systems, which can damage aircraft if accidentally triggered (which happens more often than you’d think).

4. The Fastest & Most Efficient Private Aviation Service

Sky Harbour is designed to minimize the time to wheels up.

Private hangars reduce waiting times compared to traditional FBOs.

Dedicated staff ensure that each aircraft is ready for take-off in the shortest possible time.

Owners can park directly in the hangar, board the plane, and fly.

Traditional FBOs handle large volumes of aircraft, often leading to delays. Sky Harbour eliminates this bottleneck.

5. Additional Revenue Streams: Upside Beyond Hangar Rentals

While Sky Harbour’s primary revenue source is long-term hangar leases, the company is strategically expanding into additional service offerings:

▶️ Aircraft Detailing & Cleaning – Specialized services for luxury jet maintenance.

▶️ Fuel Sales (Low-Margin Add-On) – Generating extra revenue while maintaining a light operational model.

▶️ Third-Party Service Partnerships – Outsourcing specialized services while taking a revenue share.

🗣 “Remember, light fuel, we are really coupon clippers here, right? We never own the fuel. We don't provide the detailing services. We facilitate a third party providing those services and we take the cut of the revenues. And that will be the model for most, if not all, of the dozen or so additional revenue streams that we're looking to put in place.”

Tal Keinan, CEO - 1Q ‘24 results

6. Tenant Satisfaction & Brand Strength

Sky Harbour is establishing itself as a premium brand in private aviation. Its exclusivity attracts both individual jet owners and corporate clients.

🎥 Examples of celebrities enjoying Sky Harbour’s private hangars:

Sky Harbour’s Strategic Advantage: Airport Recognition

Airports recognize the value Sky Harbour brings and are collaborating to expand facilities.

📌Example: Stewart Airport in New York awarded Sky Harbour a 12.5-acre development project based on8:

“Quality of its development proposal.

Its demonstrated ability to attract users for the proposed development.

Its significant capital investment commitment; and

The financial terms of its proposal that meet the Port Authority market valuation.”

Airports recognize the way Sky Harbour operates, and their ability to obtain the financing to develop the projects.

📈 Long-term, Sky Harbour’s presence enhances airport infrastructure, improves aircraft traffic efficiency, and indirectly benefits FBOs by boosting overall airport activity.

Final Thoughts: Sky Harbour’s Unique Market Position

☑️ A first-mover advantage – Securing premium airport real estate before competitors.

☑️ A differentiated business model – Long-term rental income vs. fuel-dependent FBOs.

☑️ A premium brand in luxury aviation – Positioning itself as the gold standard for private jet storage.

☑️ A complementary player to FBOs – Enhancing airports rather than disrupting existing operators.

VI. Sky Harbour’s Hangars: Innovation, Strategy, and Market Positioning

Proprietary Hangar Design

Sky Harbour has developed a proprietary hangar design that allows for flexible configurations based on customer needs. These include:

Single hangars – Designed for individual aircraft owners.

Double hangars – Accommodating two aircraft per tenant.

Semi-private hangars – A hybrid model offering a balance between private and shared storage.

Materials & Construction

Sky Harbour’s hangars are primarily constructed from steel and concrete, making them relatively straightforward to build. However, certain components—such as vertical lift doors—add complexity to the construction process.

As a new company, Sky Harbour faced early design challenges, but these have since been resolved, leading to continuous design improvements.

In-House Manufacturing & Engineering Control

To enhance control over its construction process, Sky Harbour acquired a majority stake in RapidBuilt, a pre-engineered metal building manufacturer. This move aims to:

Streamline hangar production, reducing construction risks.

Ensure structural integrity, avoiding past design issues.

Create standardized, scalable hangar prototypes across all locations.

SH-16 Prototype: Sky Harbour’s Initial Standard Hangar of 16,000 SF

This hangar was designed to:

✔ Store large private jets (e.g., Gulfstream G650, Bombardier Global 7500).

✔ Accommodate one large or two medium jets per hangar.

✔ Include private office and parking spaces for tenants.

🎥This is an aerial view of Sky Harbour's campus at Miami Opa Locka Executive Airport:

However, while ideal for large aircraft, the SH-16 model is less economically viable for mid-size jets, which require only ~5,000 SF of space.

The New Flagship Hangar: The SH-37 (Semi-Private Models)

To optimize its business model, Sky Harbour introduced the SH-37 prototype, a 34,000+ SF semi-private hangar, with 6,000 SF of office space, that:

✔ Doubles the capacity of the original SH-16.

✔ Supports multiple aircraft (typically three per hangar).

✔ Provides private office and parking spaces for each tenant.

📌 The first prototype was first introduced in Miami’s Phase II under development, as a preliminary version of the SH-37, with the first full SH-37 implemented in Colorado (APA) and later at Salt Lake City (SLC).

Why the Shift?

A significant portion of the private jet fleet consists of mid-size aircraft. For these smaller jets, requiring ~5,000 SF of space, it may not be cost-effective to rent a 16,000 SF hangar.

This marks a shift from fully private hangars to a semi-private model. While the concept remains similar, some key differences include:

Tenants share hangar space, but with only 1 or 2 neighbors.

All other services remain the same as in private hangars.

Privacy is maintained for offices and parking spaces—For example, at Salt Lake City (SLC), office space increases from ~2,000 SF to ~6,000 SF.

Doors will always remain closed to guarantee privacy and security.

🗣 “Most of those owners are very comfortable being with 1 or 2 others. Again, it's not a transient hangar with constant traffic. The door is always closed. The privacy is maintained. You know your neighbors. We're finding that works quite well.”

Tal Keinan, 3Q ‘23 results

📌Example: SLC Future Development of the SH-37

The next phase in Sky Harbour’s expansion includes the SH-37:

~34,000 SF hangar space.

~6,000 SF of office space (triple the space of the SH-16 model to guarantee privacy).

This is how it looks from the outside:

Key Advantages of the SH-37 Model

1️⃣ Increased Efficiency

The shift from private to semi-private hangars allows for higher occupancy rates (>100%).

Instead of leasing space to just one or two tenants, SH-37s can accommodate three aircraft per hangar, optimizing space utilization.

🗣 “So, for example, you can get two heavy aircraft into two Sky Harbour 16s. You can get three heavy aircrafts into one Sky Harbour [37] for the same footprint on the ground.”

Tal Keinan, CEO (4Q23 Results)

2️⃣ More Cost-Effective for Mid-Size Jet Owners

For efficient for mid-size jet owners (who require ~5,000 SF)

The SH-37 model attracts a broader customer base by offering a cost-effective solution.

🗣 “If you have a midsized aircraft, it's not necessarily justified for you to take a full Sky Harbour 16 Hangar. So, what we've done is provide private office and lounge space, but you have one, two, or three other aircraft with you in the hangar.”

Tal Keinan (4Q 23 Results)

3️⃣ Boosts Additional Revenue Streams

More aircraft per hangar = higher occupancy ratio = increased revenue from rent, fuel sales and other services.Add-on services (e.g., aircraft detailing, cleaning, and maintenance) will increase Sky Harbour's revenue.

The company plans to introduce over two dozen add-on services in the future.

🗣 “I can say that a Sky Harbour 37 can accommodate 70,000 feet of airplane comfortably. Like, we're never going to pack them in. This is never going to be a tight fit. That's not our business.

"So, for example, you can get two heavy aircraft into two Sky Harbour 16s. You can get three heavy aircraft into one Sky Harbour [37] for the same footprint on the ground. So, what we expect is when the new airports come online with Sky Harbour [37]s that the occupancy above 100% will be, I think, a bigger part of the business plan.”

Tal Keinan, CEO

4️⃣ Regulatory & Design Flexibility

New NFPA 409 fire codes no longer require fire-rated demising walls for SH-37 hangars, simplifying compliance.

Acoustic walls can be installed if needed, allowing for modular adjustments.

From Private to Semi-Private: Strategic Shift

While Sky Harbour will remain a premium/luxury real estate brand, this shift slightly reduces its exclusivity in favor of better business economics.

🛩 Does this impact Sky Harbour’s luxury positioning?

Slightly, sharing a hangar with other tenants does reduce some level of exclusivity.

However, the model remains far more private than FBOs, and the tenant base continues to consist of ultra-high-net-worth individuals and corporations.

It remains a flexible space—Division walls can be installed if needed, making the space private again.

Overall, this transition toward a semi-private model should strengthen the company’s financial and competitive positioning. If executed well, it shouldn’t compromise the business model.

It’s difficult to draw a single conclusion for all airports, as each location has its own dynamics, tenant types, and operational factors. However, I believe management understands these nuances and is working toward a more efficient and sustainable business model.

📌 For example, in the NYC metropolitan area, this approach makes perfect sense. These aircraft are likely to fly to nearby airports such as Teterboro to pick up passengers, and some tenants may operate a fleet of multiple aircraft, making semi-private hangars a practical solution.

🗣 “I will say that the semi-private is really a breakthrough for Sky Harbour.”

Tal Keinan

VII. Sky Harbour’s Competitive Advantage vs. FBOs

Premium Pricing vs. FBOs

Sky Harbour charges 80-100% higher rent than FBOs, justified by its unique service and limited supply of hangar space.

Can FBOs Replicate Sky Harbour’s Model?

Probably not, for several reasons:

Contractual Restrictions – FBOs might operate under strict ground lease agreements with airport authorities, limiting their ability to transition into private hangar development.

Capital & Time Constraints – Private equity-owned FBOs have short investment horizons (5-7 years), which do not align with the long development timelines required for building new hangars.

Space Limitations – FBOs often lack the physical space or capacity to develop private hangars.

Luxury Jets: Costs vs. Hangar Expenses

Sky Harbour’s customers include wealthy individuals, celebrities, corporations, and charter operators.

Each client has different needs and motivations, which is good as the addressable market is wider.

💡What really matters is the total cost of aircraft ownership, including hangar rent, fuel, insurance, maintenance, etc.

Larger private jets are becoming more expensive every year. The most expensive models now reach close to $75 million, as detailed in the slide below from 2021:

📌 Case Study: Rick Ross’s Gulfstream G-550

The Gulfstream G-550, owned by Rick Ross, is a 20-year-old aircraft valued between $15-20 million.9

He currently is leasing an SH-16, which at a rental rate of $30 per square foot, would imply ~$500k of rent per year. This amounts to less than 3% of the purchase price of his aircraft.

For a more expensive plane, like a new G-650 with an estimated price of $70 million, renting a private hangar costs just 0.7% of the aircraft’s purchase price.

Websites suggest that operating this aircraft for 400 hours per year costs over $3 million.10 In this case, hangar rent represents less than 15% of the total annual cost, while providing significant benefits to the owner.

📊 Only for the top owners: If Sky Harbour achieves its goal of 50 campuses, serving as the home base for ~750-1,000 aircraft, it would represent only ~4-5% of the total U.S. private jet fleet (22,000 aircraft) and ~15-20% of the heavy jet segment (5,500 aircraft).

VIII. Sky Harbour Development Process and Business Model

Vertically Integrated Development

Sky Harbour has partially vertically integrated its construction process through the acquisition of RapidBuilt. While the company still relies on third parties for execution, this integration provides a significant competitive advantage, enabling faster project execution than competitors.

Being vertically integrated is a major advantage, allowing Sky Harbour to move faster than anyone else.

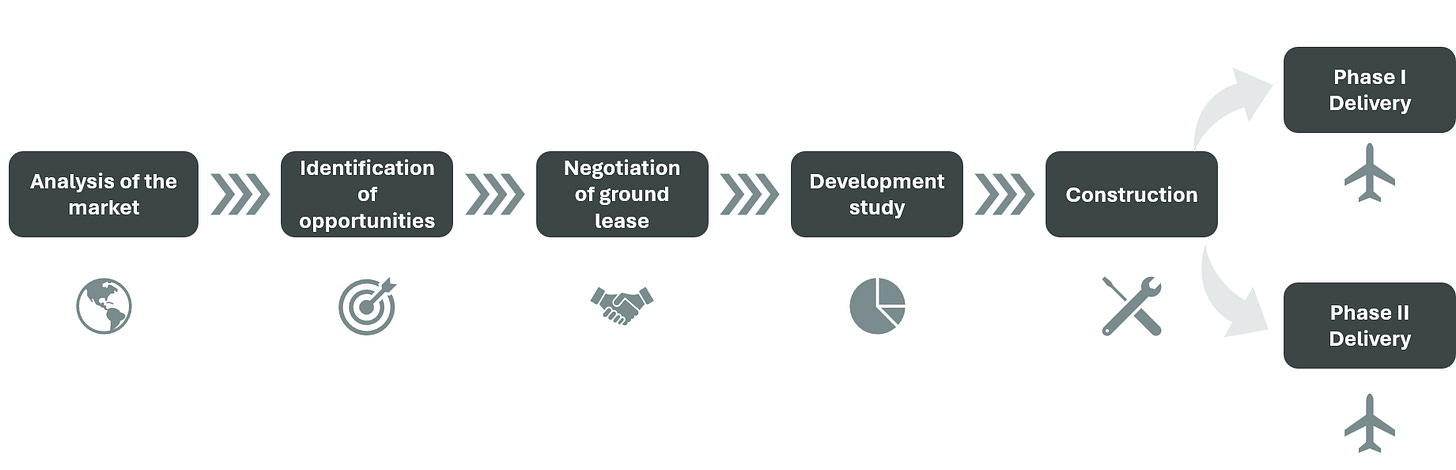

Developing a new Sky Harbour campus is a multi-year process, structured as follows:

IX. Sky Harbour Aims to Develop 50 Campuses by the End of the Decade

🗣 “It’s absolutely possible [to have 50 locations in the next 3-5 years]. I hope I’m not spoiling anything. I think it might be possible to exceed that as well”

Tal Keinan, CEO, in Emerging Growth Conference (link)

Since its founding in 2017, Sky Harbour has:

✔ Secured 16 airport ground leases.

✔ Identified 207 potential future locations - validated/contacted 45.

✔ Focused on high-rent, high-demand areas (New York, California, Florida, Texas, Illinois, Washington DC, etc.).

Aircraft are concentrated in several high-rent regions, where rental rates can be significantly higher than those of less crowded airports.

Key Takeaways from the Market Data:

The number of validated and/or contacted airports is already 45.

The New York area is the most crowded and expensive region in terms of SHER (Sky Harbour Equivalent Rent). During the last year, the company has signed leases at 4 airports in that area.

California, Florida, Texas, Illinois, and Washington are key expansion opportunities, where Sky Harbour is actively developing projects.

Here is the full list of sites and the project status:

📈 While achieving 50 sites is ambitious, the company has made substantial progress in just a few years.

2025-26: A Key Inflection Point

The years 2025-26 will be critical for the company as many projects become operational.

By 2026, at least two New York metropolitan airports will begin operations.

If rental rates exceed expectations, the impact on Sky Harbour’s financials will be significant.

X. Management Team

Tal Keinan - CEO

Tal Keinan served in the Israel Air Force for 18 years, piloting the iconic F-16 fighter jet. After serving in the military, he founded Clarity Capital in Israel in 2007. The firm manages more than $1bn assets11

During his career he served on:

The Advisory Board of the Ariav Commission

The Bank of Israel

Finance Ministry task force on the creation of a global financial center in Israel

He is very active in the Jewish community too. Among other roles, he is Chairman of KIEDF, Israel’s largest non-profit lender to small business, and the author of God in the Crowd.

📌Here is a good interview with Tal Keinan on Spotify:

Keinan founded Sky Harbour after acquiring a private jet and realizing he had no suitable place to store it. He is building a strong company culture, focusing on:

Client experience – Delivering the highest quality service.

Rapid execution – Aggressively expanding the business.

📌Additional Interviews Worth listening to:

🤝 Skin in the game: Keinan owns 42% of Class B shares, representing 27% of voting rights (as of Sep'24), demonstrating strong alignment with shareholder interests.

Francisco Gonzalez - CFO

Francisco Gonzalez has extensive experience in capital markets. He spent 17 years at Goldman Sachs where he led or participated in more than $25 billion in municipal bond financings, interest rate swaps, and public-private-partnerships in the infrastructure space, with an emphasis on airports.

📌Here’s an interesting interview with Gonzalez on Spotify:

Remaining Team: Expertise Across Key Areas

Operations: Sky Harbour’s COO comes from the construction sector, ensuring expertise in large-scale development.

Aviation Expertise: Several executives hail from FBO giants like Signature Aviation (e.g., Director of Airports, Director of Field Operations).

Acquisition Team: Difficult to assess externally, but so far, they have successfully negotiated highly attractive ground leases.

🎯 Overall, Sky Harbour has built a highly capable leadership team with deep expertise in aviation, infrastructure, and finance.

XI. Addressing Common Criticisms

1- “Sky Harbour isn’t generating cash flows.”

Technically true, but misleading.

Sky Harbour is in the early expansion phase, investing in infrastructure that will generate long-term, recurring cash flows.

High upfront investment is required before reaching cash flow breakeven.

Once a critical mass of hangars is operational, cash flow will turn positive.

2- “The Company trades at very high multiples.” (e.g., 20x sales)

Again, incorrect when taking a long-term perspective.

You can’t value this company based on current financials because the majority of the sites are under construction.

Sky Harbour is planting the seeds; the value of the harvest will only be reflected in its financial statements in the coming years.

3- "It's just hangar space - many executives just want to have their plane ready to fly and don't care for the rest"

Partially true, but Sky Harbour provides unique advantages:

Privacy & security – Essential for celebrities, executives, and high-net-worth individuals.

Fastest time to wheels-up – Saves time compared to FBOs.

Better aircraft storage – Prevents hangar rash, corrosion, and weather damage.

Easier maintenance – Private hangars allow on-demand servicing.

4- "The company has no moat."

Sky Harbour has a strong moat based on barriers to entry:

Land scarcity – Once Sky Harbour secures a ground lease, there is little to no available land left for competitors. Airports have no expansion opportunities.

High capital investment – Competitors would need to raise a significant amount of capital to match Sky Harbour’s footprint.

Regulatory challenges – Airport zoning, approvals, and lease negotiations take years to finalize.

First-mover advantage – Sky Harbour is securing prime airport land before competition emerges.

Additionally, the company has competitive advantages:

Vertical Integration – The company’s in-house control over design and construction accelerates development.

Economies of scale – As the company expands, operational efficiency and cost advantages will increase.

Brand Strength – A recognized, premium brand will become a competitive differentiator over time.

As a reminder, FBOs are not competitors to Sky Harbour:

FBOs are contractually obligated to provide services to transient aircraft and cannot focus solely on private hangars.

FBOs are private equity-owned (Blackstone, KKR) and operate on short investment horizons (5-7 years).

FBOs lack space – Many are at full capacity and do not have the land to replicate Sky Harbour’s model.

5- "There is plenty of available land."

We already addressed this, but let’s break it down further:

Not all available land at airports is able to be developed into hangars - it may be set aside for alternative uses (logistics, maintenance, public services like fire-rescue, etc.).

In most of the airports that Sky Harbour has signed ground leases at, there is limited to no additional land available for a competitor.

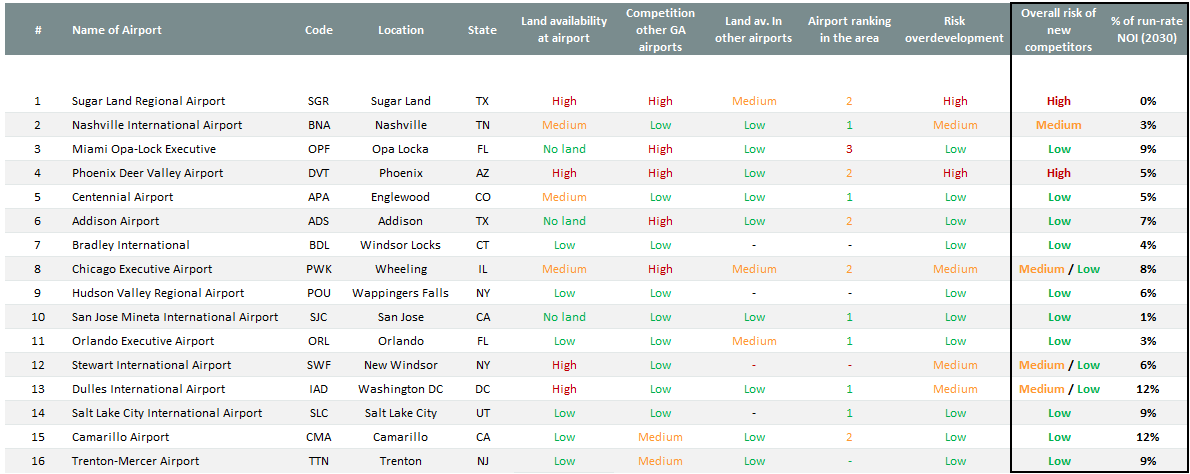

Market Risk Assessment (own estimates):

Only Phoenix and Houston show a higher risk of available land for competitors (representing 6% of NOI).

For over 60% of Sky Harbour’s NOI, the risk is very low (either because there is no land available or only small parcels exist).

For ~30% of NOI, the risk is low to medium.

📂 See appendix for additional information on land availability.

6- "Billionaires can develop their own hangars."

Building a private hangar is complex and costly:

Securing a ground lease requires negotiating with airport authorities.

Navigating approvals, permits, and zoning regulations is time-consuming.

Designing, constructing, and managing the hangar requires significant expertise.

Finding a fuel source and securing maintenance contracts is another challenge.

Total costs could be twice as high compared to renting from Sky Harbour.

Managing a private hangar requires ongoing operations, which many owners prefer to avoid.

XII. Valuation Analysis of Sky Harbour

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

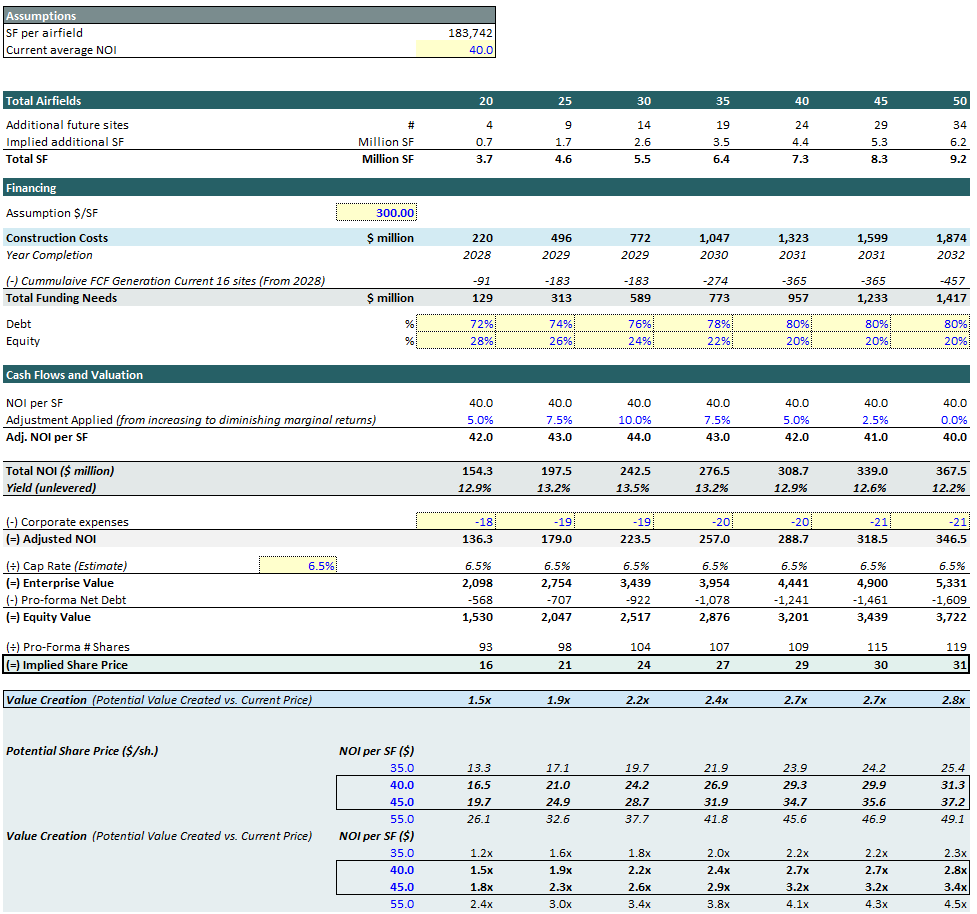

Understanding the Valuation Approach

Valuing Sky Harbour requires estimating future financing needs and the Net Operating Income (NOI) per site. Given that only a minority of campuses are currently operational, the existing financial statements do not reflect the company’s potential.

Sky Harbour has outlined an ambitious expansion plan targeting 50 airfields by the end of the decade:

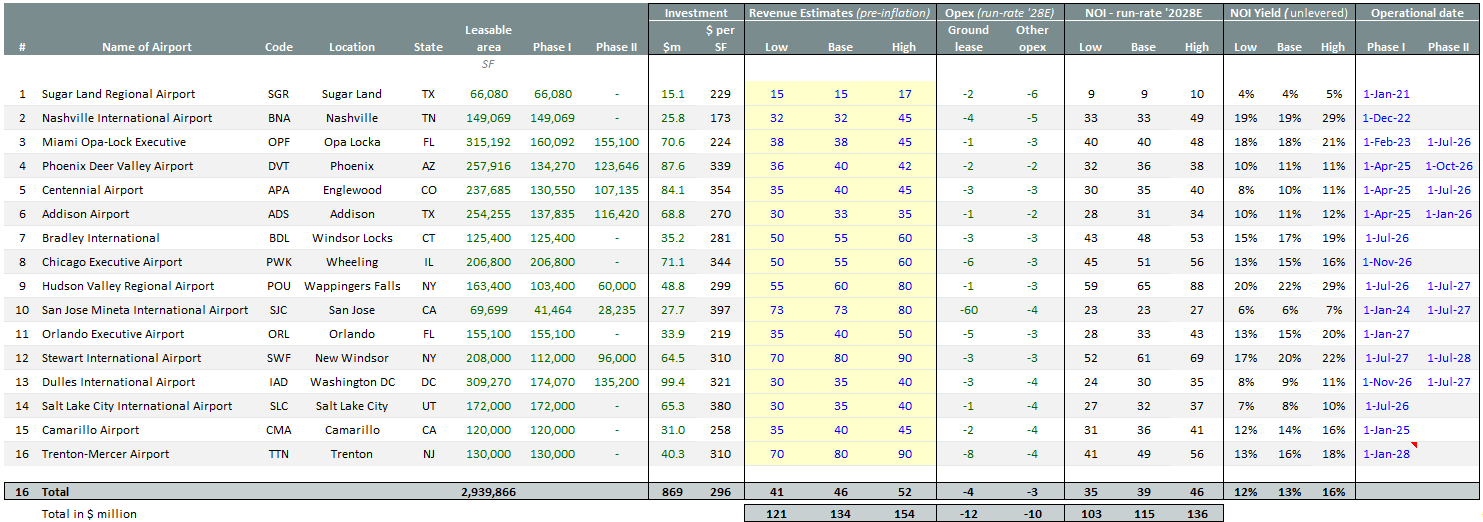

Key Takeaways from the Expansion Plan

Total Capital Requirement — $3 billion required to reach 50 campuses (~$60 million per site, up from the current average ~$50 million per site).

Leverage Projection — Debt levels will increase as expansion progresses. Leverage could reach 80% as the company scales.

Cost of Debt — Bonds were trading at a 5.0–5.4% yield in November. A 5.0-5.5% blended rate is realistic, given the company’s progress toward investment-grade status.

NOI Yield (unlevered) — Sky Harbour expects a gradual decline in NOI yield (from 14.0% to 11.5%), as the company strategically prioritizes the most profitable sites first (i.e., tier-1 sites).

💡 Key Insight: Tier-1 airports significantly boost NOI per square foot and the NOI yield: Rent at tier-1 airports can be 2–4x higher than at tier-2 airports, while operating expenses (opex) and capital expenditures (capex) remain largely fixed across locations.

Hangar Economics

Revenue Breakdown

Sky Harbour’s revenue is primarily derived from:

Rent (majority of revenue, structured as long-term leases).

Additional services, including margin on fuel (lower than FBOs).

Projected Run-Rate Revenue: $135 million once all 16 sites are fully operational:

Expense Structure

Lease agreements between Sky Harbour and its tenants are primarily Triple Net (NNN), meaning tenants cover property taxes, insurance, and utilities.

Sky Harbour remains responsible for:

Ground lease payments (the highest expense).

Operating costs (payroll, hangar operations, accounting, etc.).

Corporate expenses must also be accounted for at an aggregated level, as they are not included in individual hangar calculations.

NOI Projections

Base Case NOI estimates: Aggregated NOI of ~$40 per SF.

Financing Needs: Current Liquidity & Estimated Funding Gap

Sky Harbour funds campus construction through a mix of debt and equity.

Pro-forma current liquidity (as of September 2024): ~$185 million in cash.

Based on estimated total construction costs and expenses incurred, the company needs $600+ million to complete the construction of the remaining campuses, which could be covered by:

Current pro-forma cash position of $185 million.

~$300 million of new debt (assuming 70% leverage).

~$130 million in equity: Issuing 14 million new shares, assuming an issue price of $9.5 per share.

FCF generation from current sites will not reach meaningful levels until 2027, so it is excluded from financing assumptions.

Valuation of Existing 16 Campuses

At the current share price, the stock is fairly valued based solely on the first 16 projects, using conservative assumptions.

Same cap rate and financing needs applied across all scenarios — Sensitivity analysis (cap rate variations) suggests that in most cases, the implied share price is above the current market price.

Discounted Cash Flow (DCF) Approach

A DCF valuation approach, incorporating the time value of capital, confirms that the current share price fairly values the first 16 campuses.

Additional Upside Not Priced In

The future value creation from the construction of new campuses is not currently reflected in the share price.

Base Case: Potential valuation of c.$30 per share:

Conservative assumptions: Leverage: Increases from 72% to 80%, aligned with Sky Harbour’s business plan. Share Dilution: All shares issued at $9.50 per share (likely conservative, given the company’s growth potential). NOI estimates: Starts at $40 per square foot (No inflation considered; conservative rent assumptions, and no additional revenue from other services; Occupancy ratio of 95-100%). Cap rate of 6.5%: conservative given the asset quality, and potentially lower interest rates. Construction costs of $300 per SF: Above the current average of ~$275 per SF.

There is potential upside to these figures:

Higher NOI — Inflation adjustments, occupancy rates above 100% (from SH-37 model), stronger-than-expected rents in tier-1 markets, and revenue from additional services.

Lower dilution: If the market recognizes Sky Harbour’s intrinsic value, less equity issuance will be required.

Future Dividends & REIT Conversion Potential

Sky Harbour is expected to transition into a REIT once a critical mass of campuses is developed.

This tax-efficient structure will enable strong dividend distributions.

The projected FCF per share could be around $0.8 to $2.1 per share, implying a FCF yield of 7% to 19%, based on the current share price of $11.0 per share.

XIII. Risks & Mitigations

We have already covered some of the potential risks after assessing the negative views on the company.

1. FBOs Entering the Market

The main issue for FBOs is that they must provide services for transient aircraft.

Most FBOs are private equity-owned and unlikely to change their business model to compete with Sky Harbour.

The two largest FBOs, Signature Aviation (owned by Blackstone) and Atlantic Aviation (owned by KKR), previously tried to compete with Sky Harbour but recently dropped those efforts.

2. Is This A Recession-Proof Business?

Sky Harbour’s short operating history makes it difficult to predict how it will perform during a major U.S. recession.

However, several factors suggest it should navigate well against recessions:

Leases are staggered and have long-term horizons, reducing short-term economic exposure.

The business model targets ultra-wealthy private jet owners, who are more financially resilient.

Even in a recession, private jets still need storage, even if they fly less frequently.

3. Future Competitors

Tal Keinan expects competition to emerge in the future. However, several factors mitigate this risk:

Competitive Positioning of Sky Harbour

By the time a competitor enters the market, Sky Harbour will be 10 years ahead with a nationwide portfolio.

Over this time, Sky Harbour will have built strong competitive advantages, making it difficult for new entrants to catch up:

Economies of scale – Larger operations will lower costs and improve efficiency.

Expanded service offerings – Additional services will help maintain pricing power and increase customer retention.

The SH-37 enhances flexibility, giving Sky Harbour a competitive edge in pricing and scalability.

Barriers to Entry

A new entrant would require billions of dollars and at least a decade to match Sky Harbour’s national portfolio.

Building hangars will be more costly over time, which will make it tougher for a competitor to enter.

Land scarcity in most key airport locations limits competitive threats.

📊 Based on my research, a very low amount of rent will be considered at risk. The majority of the NOI will be low or low/medium risk, which means that Sky Harbour does benefit from barriers to entry (see appendix for more details).

🚧 Sky Harbour typically secures the last available land at an airport, effectively blocking competition. If competition does emerge and demand is not high enough, there could be pressure on rental rates since there are no switching costs for tenants. However, this scenario is highly unlikely in most locations.

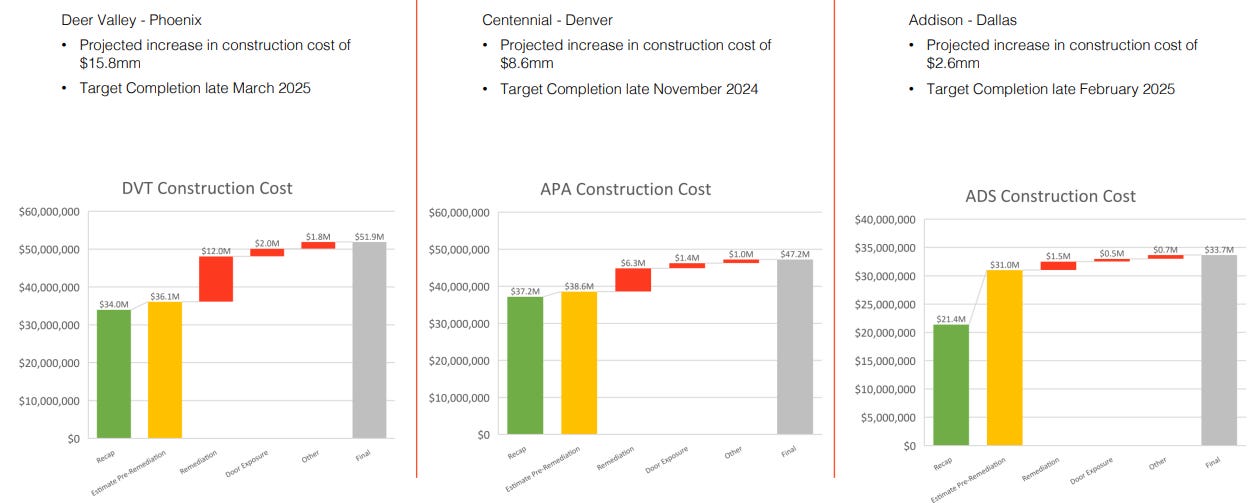

4. Construction Risk

Sky Harbour faced early construction challenges but has since resolved them.

A one-time structural design defect in a prototype hangar resulted in a ~$25 million loss.

The issue has been fully corrected, and the company is pursuing legal claims to recover part of the cost.

📌 The engineering firm in charge to review the hangar designs found out that “the root cause analysis has been determined to be a one-time structural design defect with our prototype Hanger.”

📍Example of the construction of a hangar in Deer Valley (Phoenix, AZ):

5. Execution Risk

The primary risk is failing to reach the target of 50 campuses.

However, this risk is mitigated by the fact that current valuation does not include any value creation from future campuses.

Tal Keinan remains highly confident in achieving this goal.

6. Rental Rates At Future Developments

There is a clear risk associated with future rental rates.

Tier-1 airports (including four campuses in the New York metropolitan area, Chicago Executive, and Washington Dulles) are expected to generate high returns, as rents will be significantly higher due to extreme supply-demand constraints in the market.

While this presents some risk, NYC remains the most constrained private jet market in the U.S., with rental rates expected to exceed $50 per SF.

📌 Overall, the risk that rental rates at future developments falls short is low, as these are the most crowded areas for jet storage, and the current valuation does not fully reflect the potential for higher rents in these prime locations.

7. Financing Risks

Sky Harbour will need ~$2 billion in capital to develop its 16 current sites and an additional 34 sites to reach its medium-term goal of 50 airports.

The company currently holds $180 million in cash and equivalents.

Some financing will come from issuing shares, leading to shareholder dilution.

Dilution is accounted for in our valuation.

XIV. Final Thoughts: A Long-Term Growth Opportunity

Sky Harbour is a very exciting opportunity to invest in unique, high-growth real-asset business.

Sky Harbour is an opportunity suitable as a long-term investment, as the company will not reach their targets until the early 2030s, at the earliest. However, the risk-return is very attractive.

The opportunity is based on:

Hangar space is scarce at key airports, and demand is increasing as the private jet fleet grows annually.

Sky Harbour currently has a monopoly in the private hangar space. While competitors may emerge, airport land constraints will limit supply growth.

Exceptional business economics – The company is achieving double-digit unlevered returns in multiple locations.

Room to grow and strong long-term potential – Over time, Sky Harbour will build a premium brand, introduce additional services, and establish a national home base solution for aircraft.

HOWEVER, there are some risks to consider:

It’s a young company and is currently far from their target, there is execution risk. From construction delays and unexpected costs to the inability to acquire locations for their targeted 50 airports.

Additionally, the rental rates Sky Harbour could achieve at Tier-1 airports remain uncertain, although the current valuation does not factor in exceptionally high rates.

There is a strong management team, with skin in the game and with extensive experience.

As stated before, I believe we are acquiring the current campuses at a fair valuation (based on conservative estimates) and paying nothing for:

Potential upside from existing campuses (higher rents, additional services, etc.).

Value creation from new campuses.

This opportunity depends on strong execution and patient investors.

🛩️It’s going to be a very exciting journey.

EVI.

This is not investment recommendation. It’s just my humble opinion.

Thank you for reading the report. I really appreciate your support. If you enjoyed it, please hit the like bottom, subscribe and leave a comment to stay in touch!

Appendix

CBRE report —> There are two CBRE reports, one from 2021 bond offering, and an updated one in 2023. Both are useful:

2021 SPAC presentation —> Link

Monthly construction reports —> Link

January 2025 Investor presentation —> Link

Summary of the risk of future competition in the airport based on available land:

Note: High risk of new competitors does not imply a high risk for Sky Harbour. It only highlights the possibility of new entrants.

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

End notes

Source: CBRE

Source: https://www.ainonline.com/aviation-news/business-aviation/2023-03-01/private-aircraft-fleet-grows-hangar-availability-dwindles

Source: https://www.barrons.com/articles/this-apparel-company-is-helping-disrupt-golfand-finding-powerful-allies-87859782

Source: https://www.barrons.com/articles/this-apparel-company-is-helping-disrupt-golfand-finding-powerful-allies-87859782

Source: https://www.pilotsofamerica.com/community/threads/how-do-community-hangars-work.70029/

Source: https://www.forbes.com/sites/douggollan/2020/09/26/when-a-private-jet-is-not-enough-heres-your-own-private-hangar/

Source: https://www.barrons.com/articles/this-apparel-company-is-helping-disrupt-golfand-finding-powerful-allies-87859782

Source: Sky Harbour - NY Stewart lease

Source: https://simpleflying.com/rick-ross-private-jet2024/

Source: https://www.sherpareport.com/aircraft/costs-gulfstream-g650.html

https://www.guardianjet.com/jet-aircraft-online-tools/aircraft-brochure.cfm?m=Gulfstream-G650-29

https://www.libertyjet.com/jet-ownership-costs.aspx?jetType=GC-650#:~:text=The%20total%20annual%20budget%20for,flying%20400%20hours%20per%20year.

Source: https://en.wikipedia.org/wiki/Clarity_Capital

Great job! I've been a share holder since 2022. Just some feedback on the report. I think you should go into more detail about the PABs and how they are structured. This is a tailwind for the company too as they essentially have permanent low cost debt. You marry this with the "Growing Annuity" of income from hangar rent and you have a nice spread between the cost of capital and NOI yield. Great job again!

Pretty decent job! Keep the write-ups coming