The following report aims to give a high level analysis of the current situation of the European automotive sector.

The report is based on public information obtained from:

McKinsey & Co (highly recommended to read all the reports)

European Automobile Manufacturers' Association (ACEA)

KPMG, Allianz, BCG, and others

Its not an investment recommendation.

I hope this reports provides some clarity on the current situation of the European automotive sector

1. Introduction

The automotive sector is facing strong pressures given the headwinds in the economy plus the uncertainty of the electric vehicles. In this post, we will analyze the current market, the challenges, and we will try to provide some perspectives on what could the future look like.

This report will cover the European automotive market and why I have made investments in several auto components manufacturers.

Highlights:

Europe is facing strong macro headwinds, significantly impacting the demand of new cars, which has not recovered from pre-pandemic levels

The European OEMs are now facing strong competition from Chinese EV manufacturers, as these are five years ahead in the battery electric vehicles (BEVs)

Chinese are penetrating the European continent and they are starting to gain traction in the EV segment

The EU recently launched an investigation on whether or not these manufacturers are receiving subsidies, affecting the European competitive landscape

Manufacturers of auto components are also facing strong difficulties, but the increase of Chinese competition can be a strong opportunity for those who are already working with them

2. The European automotive situation

The European automotive sector: the perfect storm?

The European auto industry is facing a challenging environment. As seen in the chart, the market has not recovered pre-pandemic levels. The industry was already facing difficulties in 2018 and 2019.

The industry continued to recover during 2023, with +13.9% new car registrations, reaching 12.8m cars produced. While its positive news, the industry is still far from recovery, as the output is 17% lower than 2017 level.

By power source, petrol and hybrid cards dominate the sales. Battery Electric Vehicles (BEV) are in line to diesel cars, a clear sign that European citizens are still not purchasing electric vehicles.

Partly is explained by the lack of infrastructure, which is in a development phase (we will cover in detail later)

The perfect storm

The European industry is facing strong headwinds and its under pressure. The automotive industry is a core industry to Europe, contributing €1 trillion to EU GDP in 2022 (~7%), employing 13.8 million people (6.1% of population) and contributing to €60bn in R&D1.

For decades, the industry has weathered multiple crises and recessions. However, it is now at a crossroads. The perfect storm has been unleashed and puts a major industry for Europe at risk. The factors are as follows:

Drop in demand

Economic pressures

The transition to the EV

Macroeconomic headwinds and high indebted companies

1. Drop in demand

As seen before, the demand was already falling prior to covid-19 pandemic and currently stands 17% below 2017 level. Volumes are close to 2012 levels, where Europe was facing one of its most severe crisis. During that year, Mario Draghi, the former European Central Bank chairman stated “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough”

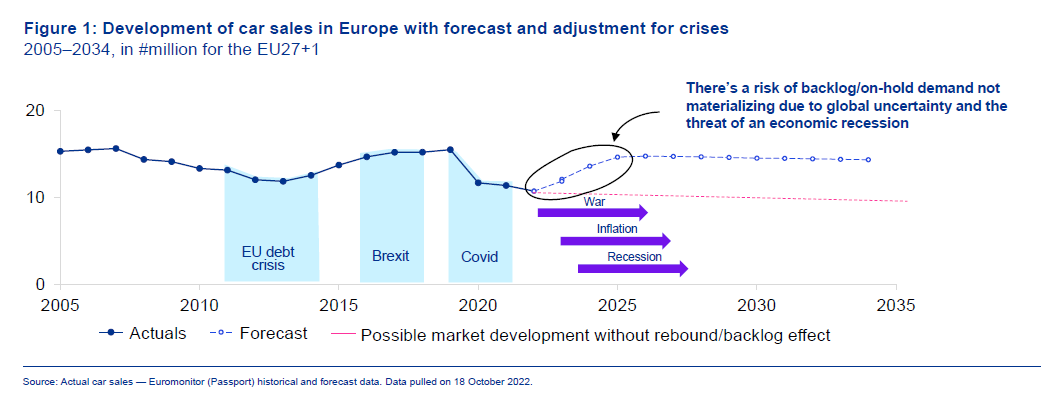

Now, demand is expected to progressively recover. But some industry experts are are questioning whether such a recovery will be possible. This chart from KPMG2 illustrates very well the evolution of car sales in Europe:

While it is a possibility that demand doesn’t recover, I believe that the EU will do their best to revive the most important industry of the continent. In a very challenging macro environment, demand is still recovering; therefore, demand can still have room for further recovery.

The fall in demand for new cars has caused the average age of European vehicles to increase. It now stands at 12 years. Countries such as Germany and France, major car producers, stand out with an average age of 10 years3.

It is a trend that is increasing and is making the second-hand market gain a lot of importance. However, this can also be an opportunity for the future. Currently, it is a difficult time to buy a car, but with the right policies (e.g. tax incentives), future rate cuts and an adequate electric car infrastructure, it is possible that we could see a resurgence in demand.

In conclusion, it seems that there is a clear floor in demand, so the sector will either recover or will have to adapt to this new reality.

2. Economic pressures

There are two trends affecting the economy of the EU:

Declining purchasing power

Aging population

The European population is loosing purchasing power. The high inflation of the last years has made cars more expensive. On average, car prices have increased by +27% since 20124 while the purchasing power of the citizens has negatively affected with the last inflation data.

Another important fact is the aging of the population. According to KPMG, the range 45-64 are the ones that purchase more cars in Germany (which we can extrapolate to all Europe given demographic trends are quiet similar):

< 45 years old: 29% of total car sales

Between 45 and 64: 47%

Above 64: 24%

According to the consultancy firm, this segment is expected to decline in the following 10 years, adding some pressure to the current demand.

3. The transition to the EV

The transition to the EV has several implications:

It affects current demand, as consumers are confused about which technology to buy and prefer to delay the purchase of a new car

The switch to EV implies that European automakers will loose part of their competitive advantages and new players (mainly Chinese EVs and Tesla) are going to add pressure

The EV has implications for the future of Europe as it is a car with significant reduced labor intensity, and will affect the economic activity

I will address the last point (I analyze the new entrants in the next section).

The EV require far less labor and components. Many studies explain that an EV requires less components and therefore, the time to build a car is much lower. One of the main elements is the power train and transmission. In an EV, electric motors are mechanically simpler than internal combustion engines, which makes them easier to assemble. In addition, the electric car does not require a gearbox like the ICE.

This means that less time is required to manufacture a vehicle as there are far fewer components to install, making it cheaper than an ICE. The main problem is the batteries, which today make these cars more expensive than ICEs. Costs are expected to come down over time.

The electric car will imply a reduction in time and components:

It is estimated that 67% less time is required to manufacture the vehicle5. This eliminates the competitive advantage of innovation and mechanical engineering domain and forces manufacturers to change their production model. This will involve making their operations leaner and will affect jobs.

EVs will require 30% less components6. At this point, suppliers of ICE components such as powertrains, transmissions, will see their business shrinking in the next decade.

This is leading OEMs to restructure their manufacturing plants. Companies such as VW have presented at their Capital Markets Day future restructuring of their production. They also need to redesign their strategy as the EV will require the redesigning the vehicle architecture and making production more efficient

Macroeconomic headwinds and high indebted companies

Since the pandemic, the automotive industry has faced multiple challenges. Some of them are still present today:

Supply chain disruptions. Remember the microchip shortage of 2021-2023?

Inflationary pressures. Inflation reached double digits during 2022 and still above 3%

The war in Ukraine. This contributed to the inflationary boost of 2022 with an unprecedented increase in energy prices

The ECB rate hikes of 2022-2023 had a material negative impact on the demand for new cars, as financing conditions have worsened substantially (from negative rates to the current 4.0%).

All of this has impacted both production and demand, and the sector is still adapting to this situation and gradually regaining efficiencies.

In this complicated context, a new player has emerged who has been working for years on the development of electric vehicles.

3. The Chinese EV manufacturers

The Chinese EV sector is penetrating the market very strongly and already has very high market shares in the EV segment.

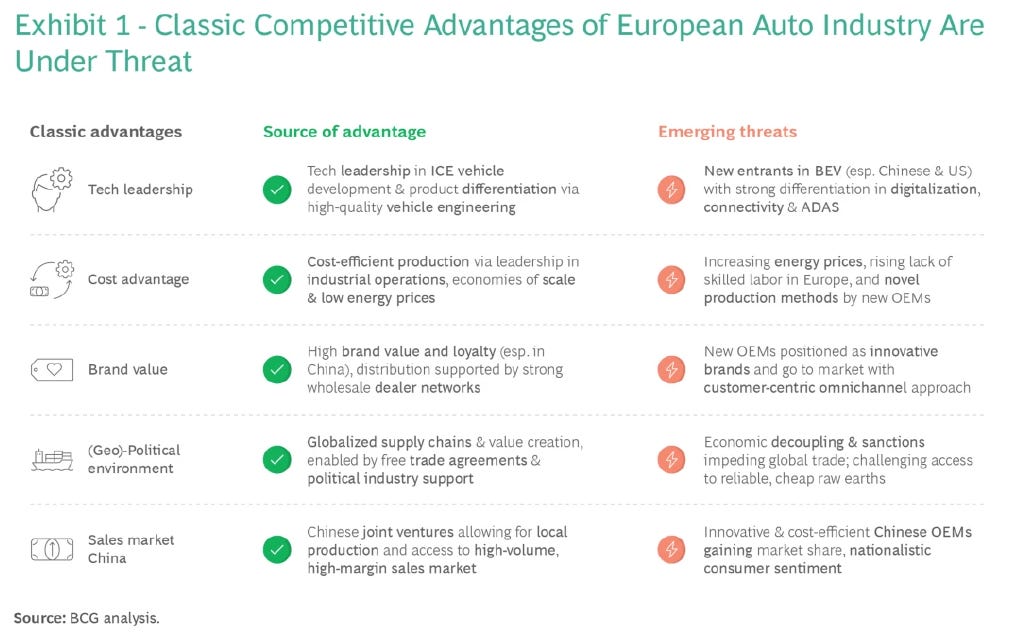

The concern is that these companies are producing cars in a very competitive way, while European manufacturers have not done their homework in time. Over the last decade, there has been a severe loss of competitiveness in software engineering, where European OEMs have been left far behind.

Now, with the emergence of the electric car, the connectivity and digitization of vehicles is gaining importance, which is forcing Europeans to react to this trend.

However, they are years behind and will have to act very quickly to close the gap. Many have already reacted and are developing a profound change in their structure.

Among them, VW, for example, stands out.

The strategic priorities of European OEMs are closing the gap with Chinese OEMs and Tesla:

Redesign the architecture of the cars and develop new models

Focus on China, to regain market share

Develop technology and software

Establish a battery roadmap to gain efficiencies in a core component

The Chinese EV competitors

Chinese EV manufacturers pose a serious threat to European manufacturers. However, the threat is currently not on the European continent but in China. China is growing strongly and is on its way to becoming the world's largest automotive market.

Globally, European manufacturers have lost 11% market share, from 35% in 2002 to 26% in 2022. New Chinese manufacturers have already captured 8% of the global share. In the EV segment, European manufacturers have lost a lot of traction. New players already have 51% of the EV share, while European manufacturers have only 20% of the market.7In China alone, new manufacturers already have a 45% share.

It is not all bad news. European OEMs continue to dominate the premium segment, where they hold a 70% market share.8

How did they gain so much market share?

The transition to EVs puts a greater emphasis on software and digitalization of the vehicle. Consumers of these cars are willing to switch brands for better in-vehicle technology, such as ADAS features and connectivity services.

These studies focus on current consumers, but do not take into account that in the future the entire population will be forced consumers. While these trends seem clear, they will not be the norm for all consumers, so not all cars will need to have huge connectivity and digital components.

In the European case it is important, as they are part of the premium segment, where the brand plays an important role but also the quality of the vehicle.

Where are the European OEMs putting emphasis?

1. Batteries: improving efficiency and, above all, production.

2. Software: new vehicles may have up to 150 control units. Investing in software is critical.

3. Adapt production. EVs require less production intensity, so production lines will have to be adjusted.

As for component suppliers, who benefits?

According to McKinsey9:

Build-to-print suppliers following OEM specifications.

Suppliers of components with EV-related material (batteries, battery boxes, etc.).

Who does it hurt?

Manufacturers of components for ICE engines, who will see their business gradually disappear.

Technology suppliers, because they will face a significant increase in competition due to the appearance of new entrants from the world of software, semiconductors, etc.

What do European manufacturers have to do according to McKinsey?10

1. Leverage the brand. European brands such as BMW, Mercedes, Porsche, are still the most valuable in the market. What they need to do is to improve their understanding of consumer needs in order to offer more attractive products.

2. Reduce costs and increase the speed of adaptation. Chinese manufacturers' costs could be up to 20-30% lower. Most critical is to reduce the cost of battery production, where Europe lags far behind. In terms of speed, European manufacturers need up to 4 years to develop a vehicle, while the fastest Chinese manufacturers can be ready in 21 months.

3. Execute a winning strategy in the Chinese market. European OEMs have already lost 5 points of market share, while Chinese manufacturers already have 10% of the market and 80% of the EV market in China. To compete in China they have to offer a more appealing product for the Chinese consumer. This customer profile is a younger person who wants more technology, ADAS and connectivity. They also prefer simplification and do not want complex purchasing processes like in Europe, where car customisation leads to complexity.

BMW is a brand that has understood this and is already working on a specific plan for China. VW has planned a China Day for 2024.

4. Create resilient, circular and sustainable supply chains. Avoid bottlenecks, supplier disruption, prioritize green materials, etc. Using recycled materials can help reduce costs and avoid pollution from the extraction of materials. In addition, the transition to EV also implies the creation of gigafactories, semiconductor manufacturing plants, which will require more than €200bn of investments.

5. Closing the software skill gap in order to develop connectivity and digitalisation in line with future trends.

Finally, it should be noted that Europe is lagging far behind in EV infrastructure. For example, 2,000 charging points are installed per week, when at least 6,000 should be installed.

Conclusions are simple:

More investment is needed

More qualified staff is needed to manage the whole energy transition.

The gap in the batteries and software needs to be closed with strong investments and strong political support

The Chinese EV producers

This extract from a EU anti-subsidy probe explains very well why Chinese are the leaders. As stated, its part of a plan that started 15 years ago.

These are the top 15 companies in the Chinese EV market:

There are several topics that need to be addressed:

Chinese players dominate the EV segment because they don’t depend on the legacy of the ICE

European companies are now developing the EV cars and are some years behind. However, these firms will eventually return and competition will be fiercely

Some firms in the lower end will struggle, as Chinese manufacturers have a significantly lower cost base than European players

In the premium segment, Europeans have an edge. In this segment, they can leverage the brand and their know-how

However, the premium segment will have more competition than before and we will see if all current firms will be able to survive

I believe its too early to say that Europeans will fail in the transition to the EV. The industry is critical to Europe and politics might come to play to protect the sector.

The problem that European OEMs face is not really in Europe, but in China. In terms of sales, they lag behind. Other firms like Tesla are competing very well against Chinese players as they are filling the gap that OEMs leaved. In the top 10 best-selling BEVs in 2022, only VW was present.

The top European brands during 2022 sold significantly less cars than the Chinese brands and than Tesla.

Although China is the biggest opportunity, it is only the third country for EU exports, behind the UK and US, respectively. As seen in the following chart, Europe exports more than 6 million cars every year, representing €171bn (14% of total exports). On the other hand, Europe imports 3.9m vehicles from China (14% of total imports)

How to fill the gap?

It will take time, but once Europeans introduce all new set of EVs into the market, figures should improve

They need to adapt to the Chinese market, to capture future growth

A European solution to manufacture batteries and develop software is critical

How big is the problem in Europe?

The first thing we need to make clear is that EV sales in Europe are lower than countries like China.

Europe has its own dynamics and the cars sold are different to China. That is why its wrong to say that Europeans lag behind Chinese because they are unable to adapt. They will adapt, but they can’t ignore their main market.

In Europe, the kings are the SUVs and they represent half of the market.

By power source, BEV market share is increasing but it is still low. Only one out of ten cars are BEV, which is lower than diesel cars! Transition to the BEV is going to take time as Europe still needs to build the infrastructure and economy is facing headwinds. The high interest environment is a clear challenge to consumption as many cars are purchased through financing.

Because transition is slower in Europe, European manufacturers are transitioning at a lower pace than Chinese EVs or Tesla. Additionally, they still need to rely on ICE to finance the transition to the EV. It will take time, but many firms will be able to offer a strong product and compete against Tesla and the Chinese manufacturers.

China automotive market is rapidly growing

The Chinese government is developing environmental policies making a favorable environment

They have pure EV players, which allows them to capture more market share

Lower manufacturing costs, especially in the development of batteries

However, they do have their risks:

They depend on subsidies from the Chinese government

Quality concerns. Safety is a major issue and these brands will face difficulties to penetrate the European market

The Chinese brands are following different strategies to penetrate the European markets. Many of them are a first step towards an entry into the region. The vast majority do not yet have a significant commercial network, so sales are still residual.

The market share of Chinese players is very small in Europe. While in China, even if they dominate the market, the European brands still hold a significant market share. But.. every year market share from Chinese brands increases.

In fact, the market share of European brands in the Chinese EV segment of 6.1% is higher than Chinese brands share in the European EV segment of 3.7%. Both are increasing their market shares, which is a positive sign for European brands given the potential size of the Chinese market.

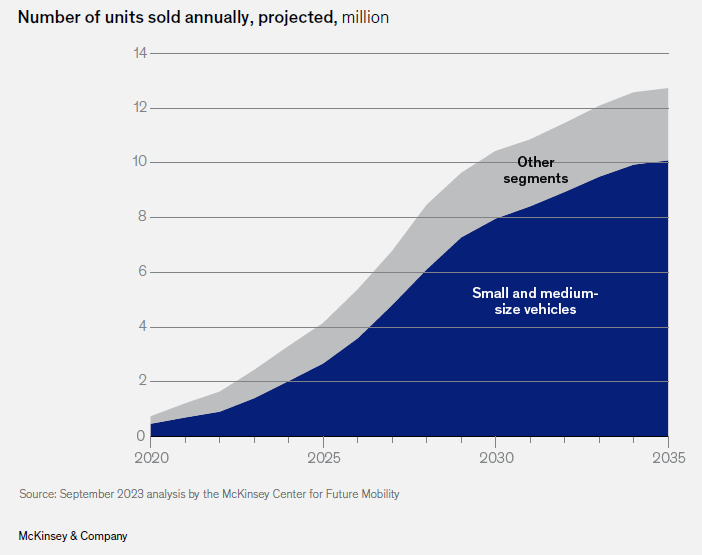

The problem will be in the entry level cars as Chinese are able to produce at lower cost. It is expected that this competitive advantage will hold during the next decade as they are 5 years ahead from European manufacturers.

Cars are expected to be smaller, where Chinese can offer the products at significantly lower prices:

There is an additional problem for the industry: the adoption of the BEV is significantly disporportionate across the regions of every country. This week, Mckinsey published another paper where it addresses this issue. It is worth reading it:

Link to the report: Winning in the European automotive industry: A micromarket approach

Finally, there is a great report from BCG that explains the main risks for the European activity, summarized in the next chart (see the report here)

How are Chinese firms penetrating the market?

There is another great report from McKinsey which explains how the different Chinese manufacturers are approaching Europe. Basically, they are following one of these models (all information according to McKinsey11):

Own retail:

Selling directly through their own network

Only Nio, Link & Go and VinFast are following this approach

Agency:

Model that combines direct-to-consumer sales with a local agent

It combines agents + own stores

Agents execute the sales on behalf of the OEM

Its a faster strategy as it doesn’t need to develop a proprietary network of stores

Xpeng, MG, Aiways and WEY are following this strategy

Import +

OEMs work with a distribution partner who is also responsible for local marketing and management

The companies maintain some interactions with the customers through their brand sites, etc.

BYD, Ora and Hongqi

Import only

Sell directly to an importer, who manages stock and everything else

The brand doesn’t interact with customers. Cars can even be sold with another brand name

Skywell, Dorcen and JAC Motors

The entry to the European markets will take time. While they are the clear leaders in their country, in Europe they face the problem of logistics. They currently manufacture cars in China and its very costly to move them to Europe

In China, there is some kind of advantage today in what is referred to EVs. And it's true that we have seen a limited impact coming out from imports from China. But as far as the logistic cost to sell vehicles from China to rest of the world, these are very relevant. But we could see maybe in the future is that we can have some of these OEMs in China with opening plants in other areas in the world. For us, it's more an opportunity rather than a risk because we are already working with them in China. So there is not a concern. But of course, right now, it's a moment of time that everybody is getting a little bit nervous.

Francisco Riberas, CEO of Gestamp

The EU response: potential tariffs?

“Global markets are now flooded with cheaper Chinese electric cars and their price is kept artificially low by huge state subsidies,” Von der Leyen

On 4 October 2023, the European Commission published a notice of initiation of EU anti-subsidy investigations into EU imports of BEVs from China. The aim is to establish whether Chinese BEV exporters' competitive edge is genuine or artificial, and also whether EV imports from China have caused injury or threat of injury to the upscaling of the nascent EU EV industry

Its worth reading. In only two pages, it covers precisely the current situation and how China has been able to become the largest BEV player.

“The probe alleges a recent surge in imports of EVs, at prices reportedly 20 % lower than those of similar EU products. Low-priced EVs, linked to a fierce price war on the Chinese EV market, may reflect battery oversupply and growing excess capacity in China. Allianz puts the EU car industry's potential annual loss in net profits due to Chinese competition at above €7 billion by 2030.”

“According to the Commission, the share of EVs from China sold in the EU recently jumped from less than 1 % to 8 %. This share could soar to 15 % by 2025. European car association ACEA suggests that the share of BEVs from China in total EU EV sales rose from 0.4 % in 2019 to 3.7 % in 2022. Various sources have stressed that Chinese firms' EV export numbers remain small (e.g. BYD, Nio, and Xpeng), and that two-thirds of EU imports of EVs from China are from legacy EU and US firms manufacturing in China”

It’s obvious that politicians need to do something to boost the EU competitiveness. I’m not sure if tariffs are the solution. Its important not to loose focus on the root of the problem: competitiveness and industrial capabilities in the software and battery spaces.

4. The auto components industry in Europe

Since the pandemic, the industry is facing strong challenges such as supply disruptions, macroeconomic headwinds and the transition to the EV. During the last 4 years, production of cars fell considerably. While it is recovering, the production levels are significantly lower than pre pandemic levels. The threat of new Chinese OEMs increases uncertainty.

The main challenges of the auto components industry remain:

Inflation. The increase in raw materials together with the increase in raw materials have negatively impacted margins of auto components manufactures. Many of these companies are not able to pass through the increase in expenses. On the other hand, their customer (the OEMs) are able to do it. Many auto components are negotiating price increases, but solutions are not arriving.

Supply chain disruption and volatility. The companies have faced disruption in the supply chain, partly explained by higher transport costs and the inability to hire qualified personnel. Additionally, the OEMs are calling for supplies in a very volatile manner, increasing the complexity of the operations of the auto component suppliers. The volatility implies that production facilities are not working 100% of the time, impacting the margins of the companies.

Transition to EV. The EV implies a new architecture, new engine, refurbished interiors, etc. Some auto components will face extreme headwinds, especially the powertrain suppliers. For others, there won’t be disruption but rather new opportunities. A key challenge for the industry is to sign agreements with new chinese entrants, as it is believed that this OEMs will disrupt the market in the next decade.

Leverage. The companies are highly indebted (between 1.0-2.0x EBITDA). However, they are generating positive FCF and are able to reduce debt and distribute dividends.

Despite this challenges, many companies remain profitable and their margins are close to all time highs. However, many are trading below 8x earnings even if the EV does not represent a threat for their operations. For that reason, the sector might be a good investment opportunity.

However, not all the sector remains attractive. There are several factors investors should consider:

Power train suppliers. The internal combustion engines will gradually cease to be produced in order to reach the goal of manufacturing 100% of cars with electric motors by 2035. Although this target seems ambitious and is likely to be delayed, the electric car will increasingly weigh more and more on the production lines so it is advisable to avoid suppliers of components for ICEs.

Pure EV components. Companies delivering pure EV components such as electric motors, power units, inverter, batteries, chargers, etc., will likely see rapid growth.

Local players. Global capabilities are becoming the key characteristic to survive. Diversification allow companies to be exposed to different geographical trends (e.g., today, Europe is growing much slower than China).

Excessive concentration of customers. Avoid companies that depend on one or very few legacy players that may be disrupted by new Chinese or American companies.

The focus should be on companies with the following characteristics:

The EV to represent an opportunity and not a threat or challenge (e.g., EVs have redesigned interiors with more premium elements, benefiting car interiors’ suppliers like Novem, that will see the content per auto increase)

Global operations with signed agreements with new entrants, to avoid the threat of these new entrants.

High R&D capabilities, to be a key partner for OEMs. The new EV require new materials, designs and engineering. The higher the R&D capabilities, the more value will provide to their customers.

High diversified client base, to avoid the risk of disruption.

My investments in the sector

Disclaimer. Please read full disclaimer at the end:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

The auto components sector is facing headwinds, but companies are performing well. The good companies are able to maintain strong levels of profitability in a very challenging environment.

Why I have invested in Novem and Gestamp?

They are global companies supplying OEMs from Europe, the US and China

This global exposure allows these companies to be hedged against new entrants. For example, Gestamp is already working with Chinese OEMs like BYD and Novem is capturing new EV companies

Chinese EVs are an opportunity, not a threat

However, they are still very exposed to European OEMs

The electric vehicle is an opportunity as it requires more components:

Gestamp will be able to sell additional parts like battery boxes

Novem will be benefited from the premiumitization of the cars’ interiors and will sell more content per car

These companies are very well managed and maintain strong margins (in the context of low margin industries)

They are trading at very low multiples, despite these business have proven to be resilient:

Novem trades at 5-6x FCF

Gestamp trades at c.9x FCF

Of course there are risks, but I believe these two stocks might do well in the future.

The situation could get worse in the next year. Because they trade so low, the risk is limited. On the other hand, if situation improves just a little bit, the results can be positive in a short period of time.

Leverage is limited (around 1.5x) and they will continue deleveraging in the next year

Should you be interested in the investment thesis, please see below the links to Novem and Gestamp:

The European Value Investor

Thank you for reading the report. Please leave a comment if you have any questions or comments. I will be happy to discuss it!

If you want to share with your friends:

Join the community of long-term value investors! Subscribe now to receive the latest content straight to your inbox. I will publish an investment thesis whenever I see a strong opportunity to invest in.

Thanks for reading The European Value Investor! Subscribe for free to receive new posts and support my work.

This month I activated buy me a coffee. If you like my content and want to support it, I appreciate it!

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not have a vested interest in any of the companies mentioned in this article, and we do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

Footnotes

Source: McKinsey & Co: Automotive powertrain suppliers face a rapidly electrifying future