Watches of Switzerland Group: Quick Update

Brief analysis on the potential impact from U.S. proposed tariffs

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Introduction

Dear readers,

Today I’m reviewing the impact from the proposed tariffs on Swiss watches on WOSG and try to explain the current situation.

After several quarters, the Watches of Switzerland started to recover from the Rolex acquisition of Bucherer and reach a 52W high in December 2024 at £6.00 per share. Since then, the stock has fell to ~£3.40 per share, a c.45% decrease.

There are three main drivers that explain the recent negative share price performance:

The Swiss Watches exports to the U.S. have been weak in February.

The USD depreciation vs. the GBP (i.e., the company will receive less cash flow from its U.S. operations).

The most important: the announcement of a 31% tariff on Switzerland’s imports.

I. The Swiss Watches Exports to U.S. YTD

Before analyzing the evolution of the Swiss Watches exports, I want to make clear that this is a very short term evolution, and it doesn’t affect the investment thesis.

The market always look for short-term impacts, such as the current quarter exports of watches, but 2-3 months of lower exports should not affect the investment thesis. At least, for a long-term investment thesis.

February was a difficult month for the industry. Total exports to North America declined by -6.5% during February, while Other Europe declined by -1.8%.

This was explained by:

Decline in the value steel watches of -8.0% during the month. The number of units remain similar YoY, but the value has fell by -8.0%.

This decline in value is mainly explained by the decline of the high-end segment (watches above CHF 3,000). The number of units sold fell by -16.1%. The price increases help to offset the decline, and total value in this category (the main category for WOSG) is down by -7.3% in February.

Although we don’t have precise information by geography, the 6.5% decline in U.S. exports signals that performance of high-end watches was low.

What this signals is that the current environment is not beneficial for consumption. Although the impact was compensated from a good January, overall the sentiment is bad, especially after the recent announcement of tariffs.

2. The USD to GBP evolution

There has been two different trends:

Between September 2024 to January 2025, the USD appreciated against the GBP. One GBP bought 1.22 US$ in January, down from 1.33 in September. This means that cash flows from the U.S. will be higher when translated to GBP (the currency of WOSG’s financial statements).

This trend has reversed in 2025, and now, 1 GBP buys c. 1.29 USD. On the inverse, 1 dollar was the equivalent to 0.82 GBP in January, and now 0.78 (-5% vs. January).

One important thing to highlight is that the company provided its FY guidance calculating using $1.26/£ exchange rate. So in terms of guidance, the impact is minimal. We basically came back to the previous FX rates.

If this USD depreciation trend continues, there is a negative impact for WOSG, and some mitigants:

Revenue in GBP will decline, as USD will be buying less GBP.

However, expenses and capex will be cheaper in terms of GBP.

This means that impact on cash flows will be limited, as the company is expanding heavily.

FX volatility is something normal, and since the great financial crisis there is a trend of GBP depreciating vs. the US dollar. In the long-term, converting US dollars to GBP has been positive.

Will this long-term depreciation trend of the GBP continue in the future?

The impact is unknown, and there will be cycles with USD strengthening and vice-versa.

In a normal market situation, the FX tend to be more stable. Since 2016, it has ranged between 1.40 and 1.15. The prior years were affected by the Great Financial Crisis and the Euro Debt Crisis.

Is this something to be watching closely?

Companies with foreign operations are affected by changes in foreign exchange rates. The important thing to highlight is that the company is based in one of the most developed countries in the world (the U.K.), and it’s expanding in the largest economy in the world (the U.S.).

Both economies appear to have similar problems, which could mean that volatility between both currencies will exist, but will be far from volatilities we can see in emerging markets.

As shareholders of the company is something we can’t control and we need to live with it. In any case, a movement in FX should not have a huge impact on the consolidated cash flows.

The company earns a FCF margin (pre-expansionary capex) of c. 10%. As an illustrative example, assuming 50% of revenues come from the U.S., this will be the impact on cash flows, assuming no growth:

At current estimated revenue, a USD depreciation vs. GBP will have negative impact on valuation between -£0.1 to -£0.5 per share, which compared to a share price of £6.0 in December 2025, it implies only 2-8% of the value.

If we assume no growth in U.K. revenue, and the U.S. expansion continues and the U.S. represents 50% of revenue (in terms of watches), the impact will be between -£0.2 to £-0.7 per share, which still relatively low. This scenario, excludes all the value creation from growing revenue to 50% of total watches, so it is very conservative.

In the long-term, the impact from FX should be limited. It can go both directions, and as a shareholder of WOSG is something we need to be comfortable with, because it’s a risk that cannot be managed (assuming the company decides not to hedge the FX).

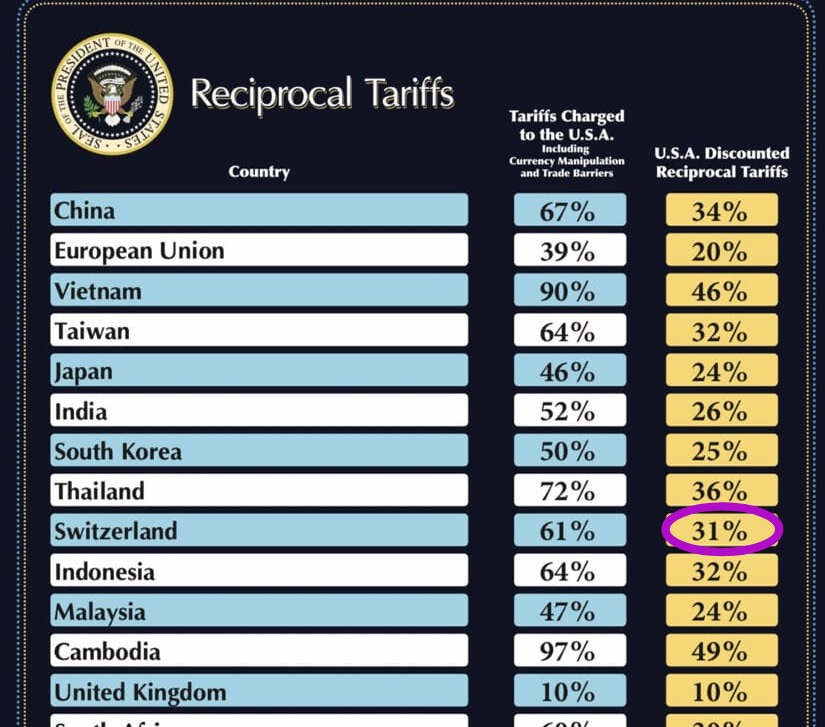

III. The Current Tariffs Include a 31% on Switzerland’s Exports

The President of the U.S. announced a 31% tariff on Switzerland’s exports on April 2nd. This tariff is significantly higher compared to other countries like EU (20%), the U.K. (10%), and Japan (24%).

This announcement lead to a sharp decline in WOSG share price as Swiss watches will face a 31% tariff:

April 3: -13.5% market cap.

April 4: -6.0% market cap.

In just two days, the company lost 20% of its market cap. This is mainly due by the fact that the U.S. is the core geography for future growth and where the company expects to expand heavily in the next years.

Switzerland was one of the most affected countries, with a tariff that makes no sense. The current 31% tariff will imply that Swiss Watches will be 31% more expensive:

Illustrative impact on consumers for a $10,000 watch

Initial retail price excl. VAT: $10,000

WOSG margin: 35%

Wholesale price pre tariff = $7,400

Tariff of 31%

Wholesale price post tariff = $7,400 * 1.31 = $9,700

Retail price post = $9,700 * 1.35 = $13,100 (+31% vs. initial price)The market reaction was to immediately think that this tariff will be real, and will be applied to all goods exported from Switzerland.

Prior to quantifying the impact, it is important to understand what does Switzerland exports to the U.S. and how much it represents.

Swiss Exports to the U.S.

The U.S. is Switzerland’s second most important trading partner after the European Union.

The U.S. represents the most important Swiss goods export market worldwide

Switzerland is the 14th most important export market for U.S. In terms of services exports, Switzerland is the 4th most important export market for the U.S.

At first glance, it can be seen that commercial relationship is strong between the two countries. The implied trade deficit calculated by Trump’s administration is due to a matter of size: the U.S. economy is ~30 times larger than Switzerland’s.

In 2024, the value of exports to the U.S. was approximately $63.4 billion1. The main goods exported are:

Pharmaceutical Product: represent ~50% of exports, affecting companies like Novartis, Roche, etc.

Precious Stones and Metals: Switzerland is the biggest bullion refining and transit hub, alongside Britain.

Watches: The U.S. is the largest market for Swiss watches, representing ~17% of watches exports.2

Optical, Technical and Medical Apparatus

Organic Chemicals

The calculation of the U.S. administration has widely been coitized as its mixing trade deficit with tariffs. The formula to calculate the tariffs is:

Tariff = Trade deficit Switzerland / Total U.S. imports from SwitzerlandWhy a 31%? Because the trade deficit is very large. This is due to:

Chemical and pharmaceutical products

Gold trade

Apparently, the trade deficit is not due to unfair competition between both countries. As we will see later, Switzerland doesn’t impose any tariff on industrial goods from the U.S.

📌The current tariff does not have any relationship with Swiss tariffs, as the country has no tariffs on industrial goods.

Swiss Watchmakers Are Significantly Exposed

It was not only WOSG, but also Richemont and Swatch. Richemont erase all the gains after the strong performance of 4Q 2024. From being up 40%, to be -3% down in the last 3 months.

WOSG is significantly exposed as the U.S. represents it’s major growth opportunity. It is were most of the growth will come in the next decade and a 31% tariff will harm the business plan.

It’s a strong setback for the industry, but given its criticality for Switzerland, we should expect that both countries will negotiate a deal to cut the tariffs on watches and many other Swiss products.

Reaction of Swiss Authorities to Trump’s Tariffs

The announcement made by Trump is supposed to be a starting point for negotiations.

Let’s take Bill Ackman’s view, as his reputation as an investor will certainly help us understand the situation:

What we can extract is the following:

The goal of current tariffs is to negotiate individual deals with the countries.

The sooner countries cut a deal with the U.S. the sooner tariffs will end.

However, the market view this 31% tariff on Swiss watches as a permanent tariff for the future.

The Swiss Federal Council Response

The immediate reaction of Switzerland was not to initiate a commercial war, but rather trying to look for bilateral solution. They are not currently planning retaliatory measures, which I believe is the right decision given the huge impact tariffs can have on Swiss economy.

“In its upcoming discussions with the US authorities, the Federal Council will seek to dispel any misunderstandings and work towards a solution.” The Federal Council

The Swiss President and Finance Minister, Keller Sutter, has planned a visit to the White House at the end of the month. Specific dates have not been publicly disclosed, but I expect they will find a solution to the current tariffs. I believe it’s very positive that she will travel to the White House.

“What we need now is to explain things around a negotiating table,” Keller Sutter told the La Liberté, ArcInfo and Le Nouvelliste newspapers.3

Some key elements will be:

Switzerland abolished all industrial tariffs as of 1 January 2024, so 99% of all good from the U.S. can be imported duty-free.

However, Swiss agricultural sector is one of the most heavily subsidized among members of the OECD. According to Reuters, agriculture is one of the sector most exposed to U.S. demands for countries to open up their markets.

There are mitigants in favor of Switzerland:

No tariffs applied on industrial goods.

The USA is the largest recipient of Swiss direct investment: Switzerland ranks sixth among foreign investors in the USA and first for investments in research and development4

Part of the deficit is due to trade gold and pharma products. It’s not an unfair competition.

IV. Quantifying The Impact From Tariffs

WOSG has lost nearly 45% of its market cap since reaching a 52-week high back in December 2024.

The market’s reaction takes as permanent the current tariffs.

⚠️THE FOLLOWING IS AN ILLUSTRATIVE EXAMPLE - NOT INVESTMENT RECOMMENDATION⚠️

The current valuation implies a market cap of £820 million, for a company that generates a FCF of ~£130 million pre expansionary capex, and ~£55 million post expansionary capex.

Given a significant portion of the capex is dedicated to open new stores, the real FCF of the company should be between £55 million and £130 million.

Using this FCF £100 million FCF as a reference, the value of the U.K. business will represent ~2/3 of the value of the watches business:

This implies that the market is current estimating an EBITDA decrease of c.50%+ in the U.S. business, after a reduction in sales of at least 17%.

Last, we assumed a valuation for Roberto Coin of £100 million which is slightly lower than the value paid a year ago. RC is affected by a 20% tariff of the European Union as the jewelery is made in Italy. Although its valuation could be lower to be even more conservative, there are synergies to consider in this transaction.

Does this scenario makes sense?

First, this is an illustrative exercise for entertainment purposes.

Under this scenario, the market believes that the U.S. business is going to be significantly impacted and that tariffs will persist over time.

If a 31% tariff persists over time, the business will be significantly impacted and the shareholders of WOSG will face a permanent loss of capital.

WOSG investors need to assess the probability of current 31% tariffs to stay in place for the coming years.

💭 In my humble opinion, the Swiss authorities will seek to sign a deal with the U.S. administration to obtain a relief on its exports, as the impact on their economy can be huge. Additionally, I believe that the 31% tariff imposed by the U.S. administration is excessive and won’t benefit the country. A deal between the two countries is the right solution.

The Swiss authorities have some leverage, as Switzerland is one of the largest exporters of gold, and the U.S. one of its largest buyers. Switzerland plays a key role in the financial markets and it these tariffs won’t benefit at all the U.S.

Last, in the recent news, Swiss response appears to be one of the most moderate approaches. While China and the EU are looking for counter measures, Switzerland is open to negotiate.

By paraphrasing again Bill Ackman, the sooner Switzerland gets a deal, the better.

If there is a deal, what could be the consequences?

If there is a deal between both countries, tariffs should disappear or be cut to at least the minimum 10% stated by President Trump.

🤝If there is a 10% tariff, the impact in the long-term will be low for WOSG:

Because an important part of the sales comes from high-end watches like Patek Philippe, with very low price elasticity, and

A significant portion of the sales comes (and will come) from the Rolex Certified Pre-Owned. These watches will not be affected by tariffs.

For premium watches, a 10% increase in price should not have a material impact. It can be absorbed between the wholesaler and the retailer.

🤝If both countries reach a deal and there are no tariffs, the long-term plan of WOSG should not be affected. However, in the short-term I will expect a difficult environment.

Even if tariffs ease, the impact on consumption will remain in the coming months until consumers regain confidence.

However, I believe that all consumption delayed implies more Rolex watches to be sold in the future. The demand for Rolex remains very high and they are the most popular watches on earth.

Even with tariffs or not, individuals will continue to seek for status. And especially for men, a Rolex is a symbol of status.

Conclusion: Am I selling any of the stock?

No.

I bought a little bit more, but I can’t buy a significant amount given its my second largest position after Sky Harbour.

I believe that the worst should be over. Now it’s time to see what happens with the negotiations. I’m following closely on Twitter, so follow me if you want to stay up to date.

WOSG has always being a volatile stock, and with tariffs these has been even worst. Even if there is a deal between the two countries, I believe it will take time to recover until there are signs of recovery in consumption.

The current environment is still very risky. As a shareholder, I’m expecting for the best, but the worst can also happen. It will remain a very bumpy road, but my decision is to stay invested until I see the final outcome of the tariffs. Sometimes, it’s better to wait and see.

Thank you for reading the report,

EVI.

This is not investment recommendation. It’s just my humble opinion.

Thank you for reading the report. I really appreciate your support. If you enjoyed it, please hit the like bottom, subscribe and leave a comment to stay in touch!

Disclaimer:

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data.

Please be aware that investing in stocks or securities carries inherent risks, and past performance is not indicative of future results. You should always conduct your research and consider seeking advice from qualified financial professionals before making any investment decisions.

The content on this blog does not constitute a recommendation to buy or sell any specific stocks or securities. The accuracy, completeness, or timeliness of the information provided cannot be guaranteed. We do not assume any liability for any financial decisions made based on the information presented in this blog.

Investors should carefully evaluate their financial situation, risk tolerance, and investment goals before making investment choices. Any reliance you place on the information provided in this blog is strictly at your own risk.

The opinions expressed in this blog are those of the author(s) and do not necessarily reflect the views of the website, its affiliates, or any other organization. The blog may contain forward-looking statements, and actual results may differ materially from those discussed.

We do not receive compensation for discussing specific stocks or securities.

By accessing and using this blog, you agree to abide by the terms and conditions outlined in this disclaimer. We reserve the right to modify, update, or remove any content without notice.

End Notes

Source: https://ustr.gov/countries-regions/europe-middle-east/europe/switzerland?utm_source=chatgpt.com

Source: https://www.reuters.com/business/retail-consumer/swiss-watch-industry-sees-tough-times-ahead-over-trump-tariffs-2025-04-03/?utm_source=chatgpt.com

Source: https://www.swissinfo.ch/eng/foreign-affairs/swiss-president-warns-against-tariff-alarmism/89118349

Source: https://www.admin.ch/gov/en/start/documentation/media-releases.msg-id-104745.html

Thanks for the well written and clear writeup.

It's definitely a value name at this point, and probably does not need a lot to do ok. I worry though that after the covid peak we have a pretty depressed luxury watches market, I have a few friends who were on waiting lists who refused the watches when they became available. And then of course there is always the risk Rolex becomes more agressive with Bucherer by keeping the daytona etc for themselves.

Looking forward to seeing your future updates on this one!

Thanks for your thoughts. From considering how luxury watch makers price their product, think long term, as well as an interview with Omega CEO, I strongly believe that even with 35% tariffs, prices won't be hiked for the U.S

Top luxury watch makers like Omega, Rolex, AP, PP want price parity in all countries they sell, so local buyers don't travel abroad to by cheaper products. Omega CEO said on tariffs that they would keep price parity. As a recent WatchPro article said, which I believe also, manufactures will likely increase global prices a few %, take the hit on U.S margins, maybe with WOSG taking a bit of margin off (but in my view mostly the manufacturer).

So I don't see prices going up in the U.S (except with a global small % increase) and with normal conditions, sales wouldn't be affected. No, of course we have lots of caution now and a possible recession which could affect things.

Also worth considering that WOSG sales is circa 50-60% waitlisted watch brands like Rolex, AP and PP, ie supply constrained, so in my view sales of these won't be affected much at all.