WOSG: Part III - Rolex and the Swiss Watch Industry

Understanding the luxury watches industry and a deep dive on Rolex

Disclaimer. Please read full disclaimer at the end of the page before reading the report. This publication is only for information and entertainment purposes. It doesn’t constitute financial advice.

The information provided in this blog is for informational purposes only and should not be considered as financial, investment, or professional advice. The valuations and analyses presented here are based on publicly available information and our interpretation of such data. By reading this blog, you agree to release us from any liability

Dear reader,

A year ago I published my investment thesis about Watches Of Switzerland Group. During January 2025 I updated the analysis and today I bring the latest part: Rolex and the Swiss Watch Industry.

In case you missed the initial write-ups:

In this part III, we will cover the luxury watches industry. From what makes a mechanical watch desirable, to why Rolex is the most iconic brand.

Index

Part I: The Swiss Watch Industry

Part II: The Future of The Industry

Part III: Rolex

Appendix

Part I: The Swiss Watch Industry

Origins and Early Development

The Swiss watch and clock industry originated in Geneva in the mid-16th century, gradually expanding throughout the Jura Mountains of Switzerland. For centuries, Switzerland's industry primarily focused on clocks and subsequently pocket watches, gaining a very strong reputation for its high quality products.

Emergence of the Wristwatch

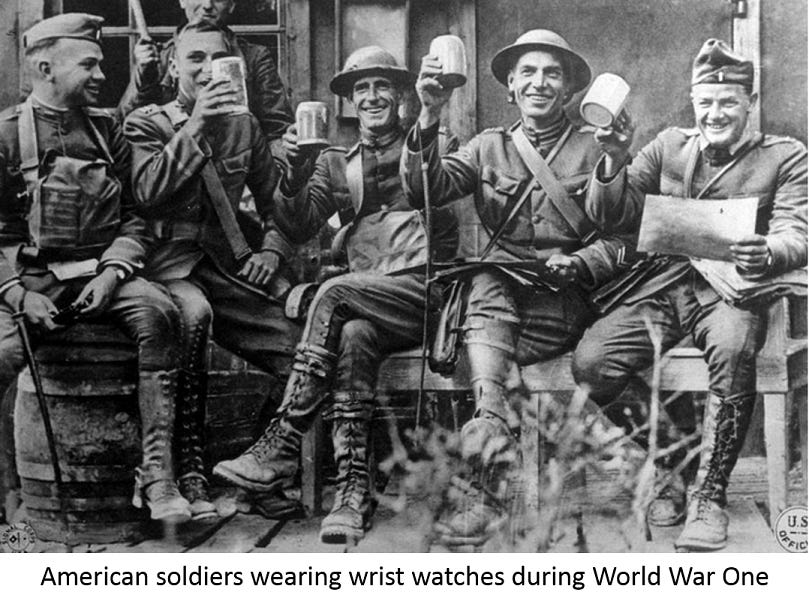

Cartier was among the first companies to introduce wristwatches at the beginning of the 20th century. However, wristwatches only gained widespread popularity after World War I.

Prior to the 1920s, wristwatches were uncommon, with most individuals preferring pocket watches. Early innovators, including Rolex and Cartier, pioneered the development of wristwatches despite significant challenges:

Manufacturers needed to ensure precision despite the considerably smaller size of wristwatches.

Wristwatches were vulnerable to environmental factors like dust and humidity.

These issues make complex to built a reliable wristwatch in a time with no smartphones and watches everywhere.

Post-WWI Growth

“The first men shipped off to train for war in Kansas City were given a wristwatch and a pound of smoking tobacco as a token of appreciation. Manufacturers such as Longines, Omega, Cartier and Rolex began crafting “trench watches” advertised for military use.”1 Worldwar1centennial.org

After WWI, Rolex and other Swiss brands began to innovate and create watches that were precise and reliable. During the following decades, these companies introduced the features known today: sealed, and automatic watches.

During the WWII, Swiss brands manufactured watches for the different armies. It was a more technological war than WWI that required much more precision. Rolex, for example, was a key supplier to the British Royal Air Force.

During the decades of the 1950s and 1960s, there were many innovations in the mechanical wristwatches making them very reliable watches. Because Switzerland remained neutral during the WWII, they were able to introduce themselves in the major market: the United States.

Brands like Rolex and Omega had a lot of success after the war. Rolex was sending watches to the U.S. presidents, Omega supplying NASA astronauts, etc.

It were buoyant decades for the Swiss watch industry, until the late 1950s, early 1960s, where a new revolutionary system was introduced: the quartz watch.

Quartz Revolution and Crisis

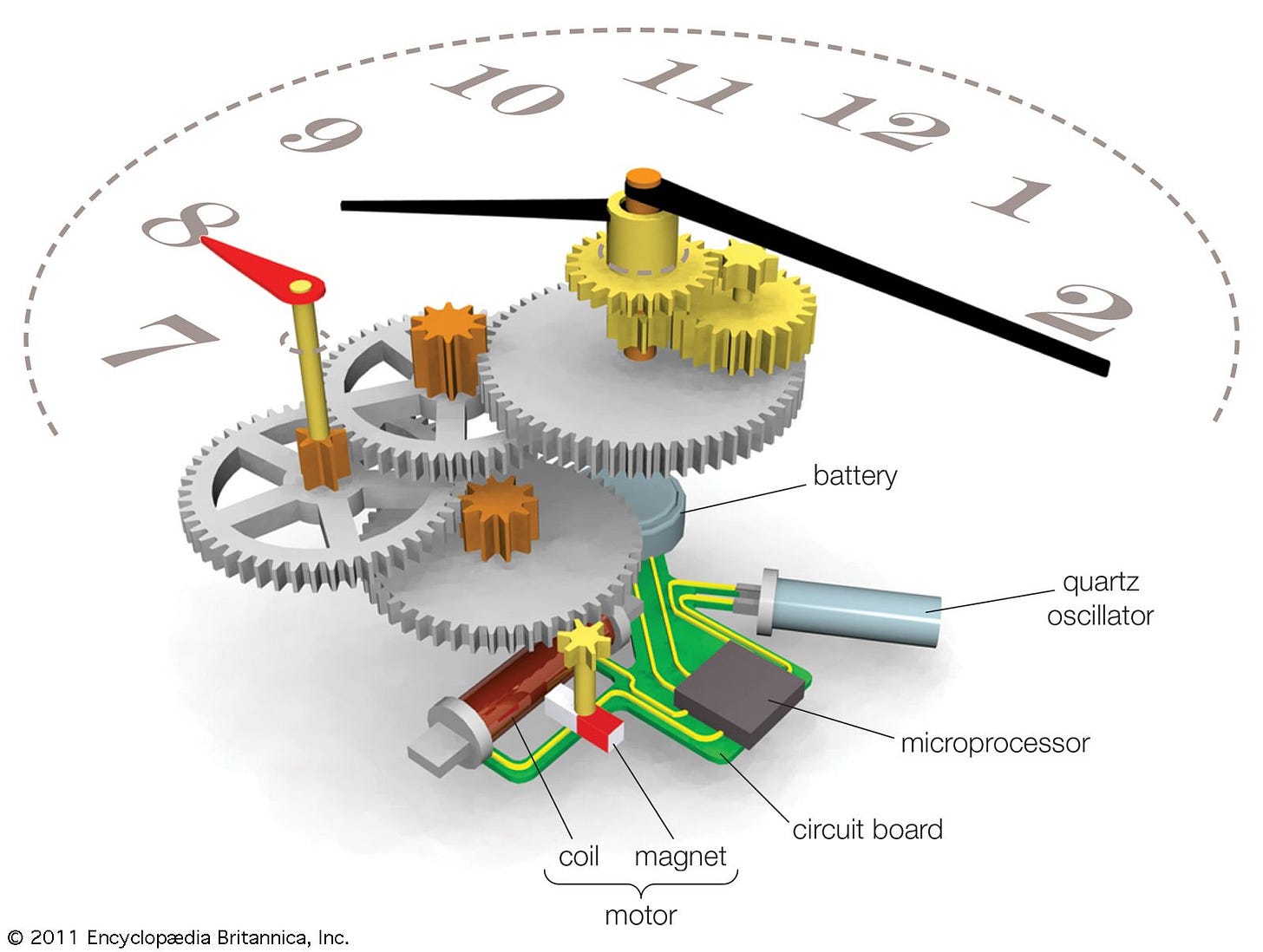

In the late 1950s and early 1960s, the advent of quartz technology significantly transformed the industry. Quartz watches, powered by battery-operated quartz crystals, offered unprecedented accuracy, dramatically reshaping market dynamics:

Mass production techniques made quartz watches affordable, attracting numerous competitors.

By 1978, quartz technology dominated, severely impacting the Swiss mechanical watch industry and leading to widespread bankruptcies and market exits.

Hong Kong emerged as a major exporter of electronic watches.

The system, compared to automatic watches, is significantly less complex, allowing for mass production and lower expenses. New watches will be significantly cheaper, and even more precise.

Response and Revival

Same as with other revolutions, as this new technology advanced and mass production techniques were developed in the 1970s and 1980s, watches became much cheaper and easier to manufacture, attracting a huge number of new players.

By 1978, quartz watches overtook the Swiss mechanical watches, plunging the Swiss watch industry into the “quartz crisis”. As a result, many famous Swiss watch house disappeared. In the decade of the 1970s, and beginning of 1980s, the number of Swiss watchmakers dropped from 1,600 to 600.2

Outside Switzerland, the history repeated: this new industry attracted a huge number of players, especially in the U.S., where the vast majority of firms went bankrupt and Hong Kong became the largest exported of electronic watches.

The crisis defined the Swiss industry of today:

Rolex decided not to move to quartz watches. Maybe because they are led by a foundation, they were not interested to rush into the new technology and decided to continue manufacturing their mechanical watches.

Other brands like Omega tried to enter the market, becoming a big failure and loosing its dominant position in the market.

In order to survive, the two biggest Swiss watch groups decided to merge in 1983 to create The Swatch Group. This movement will allow the Swiss watch industry to revive and today, the Swatch Group is the largest manufacturer in the world.

The high-end watches became highly valued by auction houses. Watches like the Daytona wear by Paul Newman was sold by $17.8 million. This will revive the industry too, as people identified strong value in these timepieces.

The emergence of the Apple Watch

Prior to the launch of the Apple Watch, there were only specialized fitness watches, mainly designed for runners and triathletes.

Apple created a new market that will compete directly with traditional wristwatches: the smartwatch.

Although by that time the utility of a watch was already close to zero, watches were part of someone’s outfit. Now, smartwatches track our sleep, calories burn, and make us 100% connected to notifications.

Because we only use one wrist for a watch, smartwatches have displaced cheaper or premium watches. This has significantly affected the low price and premium brands.

Since the launch of the Apple Watch in 2015 and the emergence of smartwatches:

Luxury watches (above CHF 3,000) have increased from 1.6 million units in 2015 to 2.0 million units in 2024

Exports of watches with pricing below CHF 500 have decreased by more than 50% since 2015

Premium watches (between CHF 500 to 3,000) have decreased by 25% since 2015

Companies like Swatch Group have seen their revenues decrease since 2015, despite owning the Omega brand (top 3 brand in the Swiss watch industry).

Watches of Switzerland sells mainly watches of the CHF 3,000+ category, and some between CHF 500 to 3,000, being Rolex, Patek and Audemars the main brands sold in their stores.

Although the smartwatch can’t be seen as a direct competitor to Rolex, smartwatches compete with watches for a place in our wrist. The low-end brands like Tissot, Longines or Tag Heuer are probably suffering the most. For similar price range, if consumers need to decide between mechanical watch and smartwatch, the answer is simple: functionality will be preferred, as these watches do not provide any status.

For the true luxury brands, a smartwatch is not a direct competitor in the majority of the cases, and since the introduction of Apple Watch, the high-end industry has only increased its popularity and desire.

Probably, the Apple Watch introduced to many people the habit to wear a watch, which ultimately benefit companies like Rolex, as many people will understand its power, and will move from a notification/sport monitoring watch, to a timepiece that elevates the person.

Figures of the Industry

Currently, the top 50 Swiss watch brands produce over 15 million watches annually, achieving a wholesale market value surpassing CHF 30 billion (~€33 billion).

Luxury brands like Rolex, Patek Philippe, and Audemars Piguet focus exclusively on limited-production mechanical watches, consistently raising their prices, and limiting the supply of its products (i.e., they never match supply to demand).

Despite the competition posed by smartwatches, the luxury segment remains robust. Swiss watch exports are c.20% higher than 2015, with a positive trend since the pandemic.

By region, the U.S. remains as the largest market, representing 17% of total exports, while Asian countries China, Japan, Hong Kong, and Singapore represent ~30% of total exports.

Market Participants

The Swiss watch industry features a diverse landscape of brands in both mechanical and quartz categories:

Independent Brands: Rolex, Patek Philippe, and Audemars Piguet remain influential, independently-operated brands.

Luxury Conglomerates:

Swatch Group: Largest watch manufacturer globally.

Richemont: Owner of luxury brand Cartier.

LVMH: Major brands include Hublot and premium brand TAG Heuer.

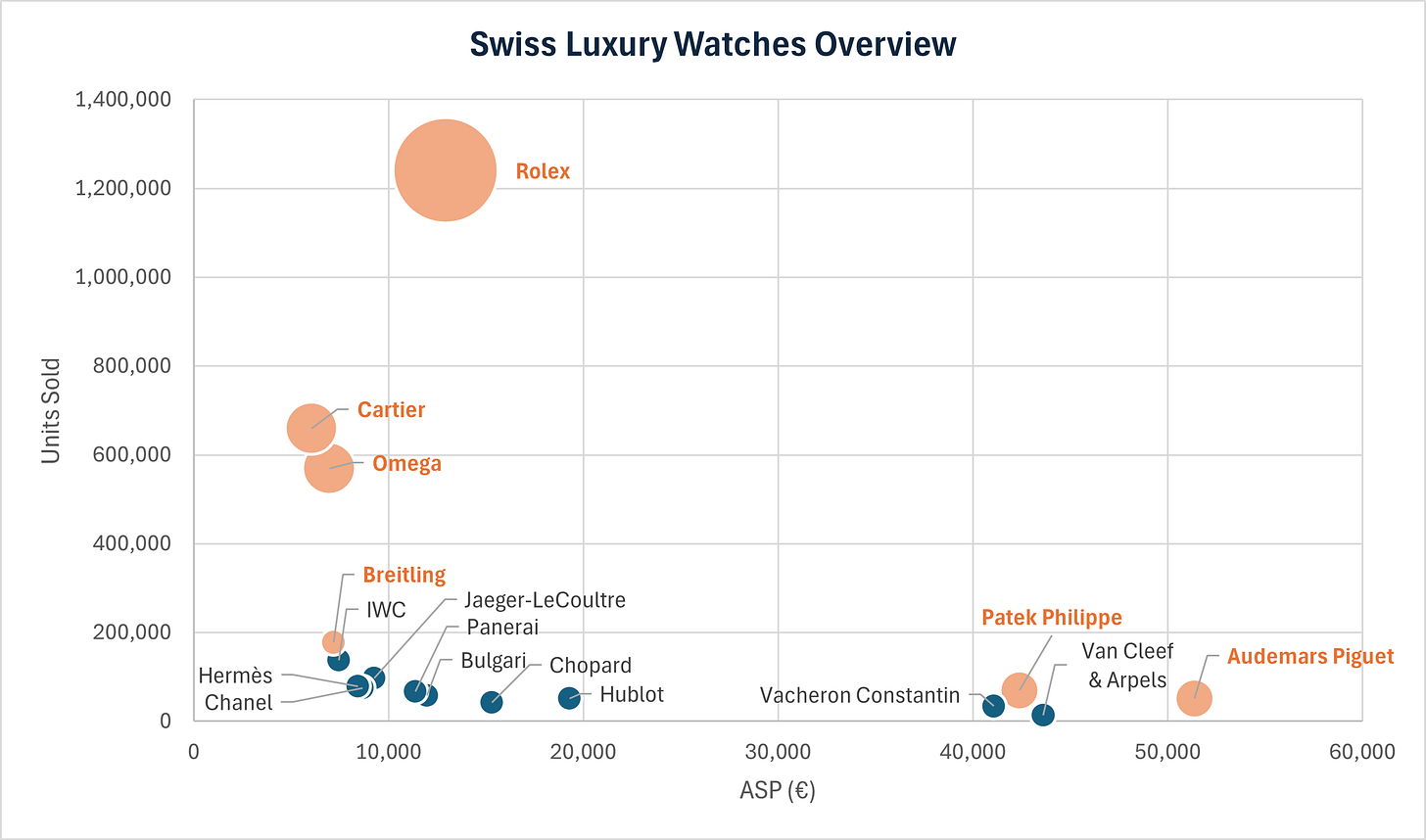

Morgan Stanley estimates Rolex as the largest industry player, accounting for approximately one-third of total industry revenue. The top brands by unit sales and revenue are Rolex, Cartier, Omega, Patek Philippe, and Audemars Piguet.

According to Morgan Stanley, Rolex has a market share of 30%. They are the absolute leaders of the market, followed by Cartier and Omega. They are 3x bigger than the second market participant.

Watches of Switzerland Group (WOSG)

WOSG maintains a strong market position, especially in the U.K. and the U.S., representing key brands such as Rolex and Patek Philippe.

After the introduction of the Rolex CPO program, the share of Rolex is expected to remain very high.

According to Morgan Stanley, the share of wholesale for these three brands is 100%, 85%, and 12%, of total sales, respectively (i.e., Rolex sells 100% through retailers, and Patek 85%, while AP only 15%).

As of today, WOSG is very well positioned selling the top brands in the U.S. (the largest country, representing ~17% of total exports, twice the amount to China).

The data from the Federation of the Swiss Watch Industry FH provides important takeaways for WOSG investors:

The U.S. plus the U.K. are larger than the sum of China, Japan, and Hong Kong.

These two regions remained resilient in the past two years, while exports to China have fell by 25% during 2024.

Growth in the U.S. remains very strong, while the U.K. has been more affected by recent macroeconomic environment.

The exports of Swiss watches to the U.S. have increased by +12.4% since 2022.

In the U.K., exports of Swiss watches have increased by +5.9% since 2022. Although 2024 was seen as a bad year, the value of the exports only fell by -1.6%, as Swiss companies are able to offset lower volumes with price increases.

However, it makes no sense to measure the performance of the sector in one year. Luxury brands think in the next decades, not the next quarters. The positioning of the brand and desirability of the product is what will guide the profits in the future.

Looking at long-term trends:

The value of Swiss watch exports to the U.S. has multiplied by 2.4x since the 2000s.

In the U.K., the value has multiplied by 4x since the 2000s.

Please note these are aggregated data that includes the whole spectrum of Swiss watches, from low price quartz to high-end mechanical watches. Some segments like the low-end/premium have been impacted by the appearance of smartwatches, affecting the figures.

Brands like Rolex have significantly outperformed the market, as they are focused in a luxury product which price has exponentially increased in the last decades. Although the market is focused on the recent price declines of the secondary market, Rolex watches already saw significant price increases prior to pandemic.

Here are some examples of the value of different Rolex watches:

Part II: The Future of The Industry

Keep reading with a 7-day free trial

Subscribe to Asymmetric Ventures Portfolio to keep reading this post and get 7 days of free access to the full post archives.